Money

Gold rush as sales surge predicted

By Ding Qingfen (China Daily)

Updated: 2011-06-24 09:26

|

Large Medium Small |

BEIJING - Gold's luster is continuing to attract rising domestic demand and China will continue to "outperform" other countries in private consumption of the precious metal, with sales growth remaining above 20 percent over the next two years, an industry expert said.

The amount individual buyers purchase as an investment is expected to surge two-fold annually, Zhang Bingnan, secretary-general of the China Gold Association, said.

And the government's gold reserves are "far from enough", and should be increased to fend off global financial risks, he said.

According to the China Gold Association, domestic gold sales grew 21.26 percent to 571.51 tons last year from 2009.

Since the international financial crisis China has led growth in gold sales worldwide.

This is set to continue in the coming years as the "average holding of gold by individuals is still too small and the nation's rapid economic growth will further stimulate consumption and investment", Zhang said.

| ||||

Sales can be divided into three categories: ornaments, such as necklaces, investment in gold coins and bars and industrial demand.

Since China deregulated its gold market in 2008 gold sales as a means of investment have surged, with an annual growth of 100 percent from 2007 to 2010, compared with 30 percent for the global investment market during that period.

"Enthusiasm for gold as an investment will get stronger, and domestic sales in this category will keep doubling in the next two years," Zhang said.

Zhong Wei, director of the Financial Research Center of Beijing Normal University, agreed.

"Inflation and the weakening purchasing power of the yuan have driven up private demand for gold and this will continue," he said.

Inflation, already at a 34-month high, is expected to pass 6 percent in June.

Meanwhile, Zhang suggested that the government should increase its gold reserves.

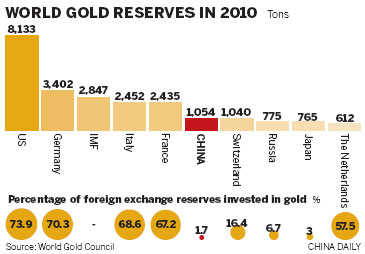

By the end of last year, China ranked sixth globally in gold reserves, with 1,054 tons. It lags far behind the US, the country with the largest reserves, with 8,134 tons.

"China's reserves are small. They need to be increased appropriately," Zhang said.

China had more than $2.84 trillion in foreign exchange reserves by 2010, but only 1.7 percent were invested in gold.

"The government needs to expand its share of gold in the foreign exchange reserves to reduce vulnerability to dollar depreciation. The reserve should be at least 5,000 tons," Zhong said.

China's gold output, mostly put into the reserves, was the world's largest for the four years up to 2010.

The output in 2010 grew by 8.6 percent year-on-year to a record high of 341 tons.

"China's gold reserves are, probably, far more than the released figure," Zhong said.

In the first quarter, China overtook India to become the largest market for private gold sales.

From January to March, Chinese consumers and investors bought 93.5 tons of gold in the form of coins, bars and medallions, more than double the amount of last year, and a 55 percent jump from the previous quarter, according to the World Gold Council.

"China overtaking India as the largest buyer of gold products on an annual basis is just a matter of time. The average gold holding in China is only one fourth of the global level, and China's per capita individual income is much higher than India's," Zhang said.

He said he believes "the gold price hike will be maintained", for the foreseeable future thanks to the European debt crisis and rising calls for restructuring the global currency system. "Gold prices could rocket if the debt crisis spreads further," he said.

| 分享按鈕 |