Economy

Small firms, big problems as costs rise

By Chen Jia (China Daily)

Updated: 2011-06-29 11:26

|

Large Medium Small |

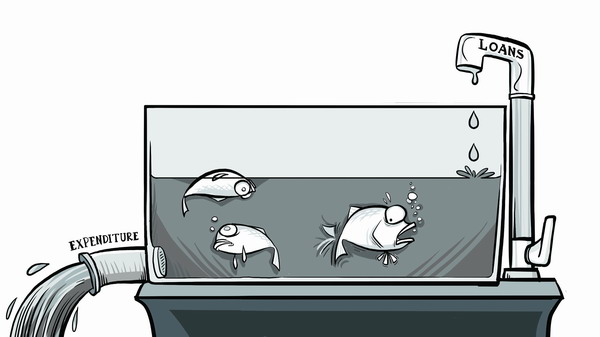

Monetary tightening

When the country's consumer price index (CPI) surged to 5.4 percent in March - the first time that it has risen above 5 percent in almost three years - the authorities emphasized that fighting inflation is the government's top priority.

In order to soak up excess liquidity, the government has opted to reduce the availability of loans, as many think the over-abundance of money in the market has been instrumental in causing rising inflation.

Earlier this month, the People's Bank of China, the central bank, raised the reserve requirement ratio (RRR) for commercial banks for the sixth time this year.

The increase came just five hours after the National Bureau of Statistics released data which showed that CPI rose to 5.5 percent in May, a 34-month high. At 21.5 percent, China's RRR is the highest in the world.

|

||||

"Now it is definitely winter for small and medium-sized companies," said Zhang Lijun of the Beijing branch of China Everbright Bank. "Because of the tight controls on credit, banks preferentially choose to lend money to big, State-owned enterprises," he said.

Small and medium-sized enterprises in Wenzhou, in East China's Zhejiang province, were among the first to suffer from the restrictions on lending.

Statistics from the Wenzhou Economic and Trade Commission show that between January and March the city's commercial banks made new loans worth a total of 23.82 billion yuan, 33.5 percent lower than in the same period in 2010. Of the local companies surveyed, 42.9 percent said they have faced a shortage of funds since the central bank further tightened the money supply last year.

The head of a lighter factory in Wenzhou - one of the city's main industries - who only gave his surname as Zhao, said he is considering closing his factory. "With the soaring prices of chemical raw materials, our net profit rate has decreased to 1 percent this year from 3 percent previously," he said.

"Many of the lighter manufacturers I know have closed their factories and opened guarantee companies, which involves lending at very high rates of interest," said Zhao. Guarantee companies make their profits by providing guarantees for borrowers, although in practice some of them also engage in lending between themselves, using funds garnered from banks.

Zhao is not alone in shifting from traditional manufacturing to investing in other areas. Media have reported that the number of companies registered with the local lighter industry association decreased to around 100 in 2011 from the peak of 3,000 some five years ago. And of those 100, more than half have cut production or simply ceased trading.

Yao Chuntao, a member of an entrepreneurs' association affiliated to the Shanghai Federation of Industry and Commerce, said that five of its 20 members have recently closed their factories and started running guarantee companies. He grudgingly admitted that most of these companies are actually engaged in unregulated money lending.

"The annual interest rate for this type of private lending can be as high as 50 percent, and for some short-term loans, it can even reach 80 percent," said Yao.

Most of the guarantee companies have borrowed money long term from other companies or banks and are lending the funds on a short-term basis, a method known as using "bridging loans", Yao said. "The leverage is very risky. If one borrower cannot pay back the money, the whole lending chain may rupture very quickly."

| 分享按鈕 |