China's economy at the crossroads

Updated: 2011-07-13 09:40

By Li Xiang (China Daily)

|

|||||||||||

China's economic outlook has left analysts and investors divided, reports Li Xiang in Beijing.

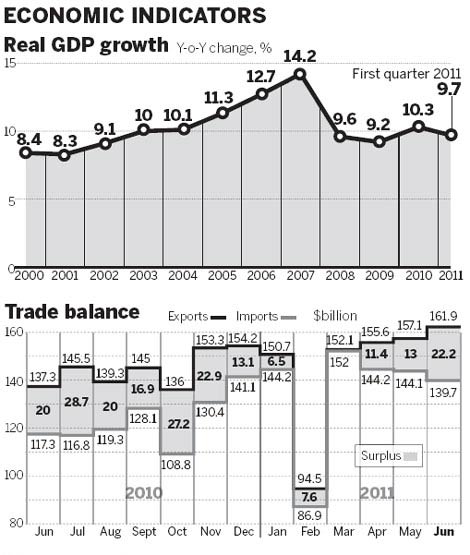

It seems more evident than ever that the Chinese economy is at a critical crossroads, with inflation soaring to the highest level in three years while other economic indicators point to a slowdown in growth.

|

The latest economic data has created a dilemma for policymakers. They have to maintain sustained growth while taming feverish domestic prices. Inflation, fueled by surging food prices, hit 6.4 percent in June and could run out of control if the central bank loosens its monetary-tightening stance. However, the risk of an economic "hard landing" leaves Beijing with limited room for further policy maneuvering.

Government measures to contain inflation are beginning to have an impact on the country's economy. Manufacturing activity, gauged by the Purchasing Managers' Index (PMI), fell to 50.9 in June, its lowest level for more than two years. The same month saw import growth also decline unexpectedly to 19.3 percent year-on-year from 28.4 percent in May. Both of these data snapshots signal a weakened domestic economy.

A series of increases in the required reserve ratio for banks to a record 21.5 percent, added to repeated interest rate hikes, have also put many of the country's private enterprises on the verge of bankruptcy.

What is even more troubling is the country's massive amount of local government debt and the rising level of non-performing loans in the banking system.

Previous reports by some foreign media outlets said local governments have borrowed as much as 14 trillion yuan ($2.16 trillion).

China's central bank denied that figure in a statement on its website on Monday night. The People's Bank of China said that analysts were incorrect in deriving that 14 trillion yuan figure from recent central bank remarks that less than 30 percent of outstanding loans in the country went to local governments at the end of 2010. The ratio of borrowing by local governments to bank lending varies, with the highest not more than 30 percent, the statement said. The overall scale of local debt is therefore much smaller than reported, it said.

In a recent report, the National Audit Office, the country's top auditor, calculated that local governments had combined debts of 10.7 trillion yuan at the end of 2010, accounting for more than a quarter of national GDP in the same year.

International rating agencies, such as Moody's Investors Services Inc and Fitch Ratings Inc, have issued warnings about China's rapid credit expansion against a backdrop of rising inflation and asset bubbles. The overall bad-debt ratio of Chinese banks may soar as high as 18 percent under a "stress-case" scenario, Moody's said in a recent report.

The problem of local government debt has become a perfect case for China bears to argue that the economy is heading for a sharp decline by 2013, triggered by a rebound in the high level of bad loans and the collapse of the property market after the lending spree in 2009.

In June, Nouriel Roubini, co-founder of the New York-based research company Roubini Global Economics LLC, and who predicted the global financial crisis, was quoted by media as saying that China's reliance on exports and investment may spur a "massive" amount of non-performing loans and cause expansion to falter after 2013.

Predictions of the imminent collapse of the Chinese economy emerged 10 years ago. In 2001, Gordon Chang, a lawyer in the United States, argued in his book The Coming Collapse of China that the hidden non-performing loans of China's "big four" State-owned banks would probably bring down the country's financial system and that the economy would collapse in 2006. Chang has copped lots of flak since then as the Chinese economy has grown increasingly powerful.

However, recent concerns about China's debt problem brought an air of dj vu, reminding observers of China's last banking crisis a decade ago when the total amount of non-performing loans in the system equaled 50 percent of the country's GDP.

Although most economists believe that the likelihood of a hard-landing for the economy is slim this time around, the high level of local government debt and the potential risk of a default on payments may indeed pose a threat.

"The current debt problem poses a real threat to China's banking system, but the risk is not imminent," said Yao Wei, an economist at the French bank Societe Generale SA.

"The same problem of a rapid rise in the number of bad loans has re-emerged in less than 10 years. It's because the root cause has not been effectively addressed: that is China's heavy reliance on investment to drive economic growth," said Yao. "The risks will continue to pile up if the government does not push forward with economic restructuring."

|