Dip in CPI may lead to policy easing

Updated: 2011-11-10 09:22

By Li Xiang and Wei Tian (China Daily)

|

|||||||||||

|

Supermarket shoppers in Nantong, Jiangsu province, on Wednesday. The consumer price index edged down to 5.5 percent in October from 6.1 percent in September. [Photo / China Daily] |

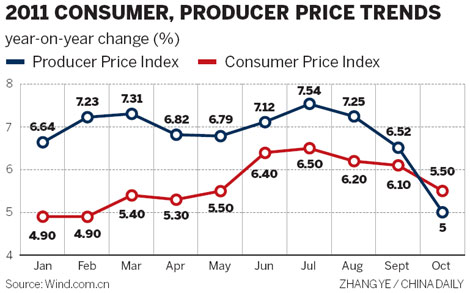

October figure of 5.5% reflects government's bid to get price hikes under control

BEIJING - With China's inflation easing to a five-month low last month, analysts said that the government will have more flexibility in conducting monetary policy as the domestic economy cools and the European debt crisis threatens the country's exports.

The consumer price index (CPI), a main gauge of inflation, edged down to 5.5 percent year-on-year in October from 6.1 percent in September, according to data released by the National Bureau of Statistics on Wednesday.

China's producer price index (PPI), a measure of inflation at the wholesale level, increased 5 percent in October from a year earlier, a 12-month low.

The 0.6-percentage-point fall in CPI was the biggest since February 2009, and it was mainly driven by a decline in food prices.

Analysts said that the easing inflation rate showed that government efforts to curb prices had begun to take effect. They said the CPI figure would give monetary policymakers more room and allow them to "fine tune" tightening measures.

"It is a clear signal that prices are entering a declining cycle and monetary policy has managed to achieve an economic soft landing," said Lu Zhengwei, chief economist of Industrial Bank Co Ltd.

Some economists said that the inflation slowdown reflected a healthy easing, while China's fiscal policy has become more proactive and tentative monetary loosening might also be underway.

The market has speculated that the cooling domestic economy, especially the property sector, combined with weak US recovery and the prospect of a recession in Europe, may prompt a shift in Beijing's policy stance toward monetary easing.

Christine Lagarde, the managing director of the International Monetary Fund, said at a forum in Beijing that countries should hold off on monetary tightening in order to lift growth when inflation is under control and exposure to external dangers is high.

But some analysts said that easing inflation is not a sufficient condition for Beijing to adopt broad monetary easing.

"There is the possibility that the central bank might cut reserve-requirement ratios (RRR) for smaller banks before year-end, but any aggressive easing would depend on at least two factors: a rapid slowdown in GDP growth and the CPI falling below 5 percent," wrote Chang Jian and Huang Yiping, economists with Barclays Capital, in a research note.

"We believe there is a growing view in Beijing that slower economic growth (as long as it stays above 8 percent), should be tolerated in exchange for quality and sustainability," they said.

Key factors

External demand, housing market developments and labor market conditions are the key factors to watch, economists said.

Most of them maintain the view that China's policymakers will keep interest rates and the RRR on hold at least for the remainder of the year.

"Even with inflation in firm retreat, we feel movement on interest rates is out of the question until well into next year," said Alistair Thornton, an analyst with IHS Global Insight.

"Lowering inflation does mean that real deposit rates are becoming less negative. They remain firmly in the red, and the government will be mindful of the effect this has on bank deposits and asset markets," he said.

Li Daokui, an adviser to the central bank's monetary policy committee, said that Beijing should maintain its current policy stance and adopt "targeted easing" to support smaller businesses that have been hardest-hit by the credit crunch.

GDP grew 9.1 percent in the third quarter, the slowest pace in two years. That figure raised concerns about a potential hard economic landing if the property market falls significantly, which could also cause systemic risks in the banking industry.