Energy firms increase the pace of overseas M&A

Updated: 2011-12-06 07:58

By Zhou Yan (China Daily)

|

|||||||||||

The country's biggest oil companies are set to redouble their efforts to expand on the international stage

BEIJING - China's rising demand for energy to support its strong economic growth, coupled with the desire of domestic companies to grow into recognized multinational enterprises, is expected to trigger a new wave of overseas expansion, led primarily by the nation's large oil companies.

In November, China Petrochemical Corp, also known as Sinopec Group, the country's biggest refiner, said that it would pay $3.5 billion for a 30 percent stake in the Brazilian unit of the Portuguese oil company Galp Energia SA, the company's latest move to buy into oil and gas reserves in the South American country.

The deal followed Sinopec's earlier purchase of a 40 percent stake in the Brazilian unit of the Spanish oil company Repsol YPF SA for $7.1 billion in 2010, as part of its efforts to increase upstream reserves. Sinopec expects to obtain 21,300 barrels of oil equivalent daily in 2015 and 112,500 barrels in 2024 through its deal with Galp.

China National Offshore Oil Corp (CNOOC), China's biggest offshore oil company, recently failed to acquire a stake in the Argentine crude producer Pan American Energy LLC, held by BP PLC. The deal collapsed in early November because of legal issues, according to CNOOC.

Even though Chinese oil companies have experienced setbacks in the global market, the country is still determined to expand internationally, experts said.

According to mergermarket.com, an independent provider of mergers and acquisitions (M&A) intelligence services, during the first nine months of 2011, energy, chemicals and materials accounted for more than 50 percent of China's outbound M&As. Industrialized countries such as the United States and Australia are the major destinations for M&A deals in terms of transaction volumes.

However, the emerging markets have not yet figured prominently in outbound deals so far. Eleanor Wu, a partner in transaction services at Ernst & Young LLP (E&Y), believes that cross-border deals in Brazil and Argentina will increase as global investors, including those from China, firm up plans to tap into the two countries to further diversify their investment portfolios. Through its "going overseas" strategy, China is aiming to build up first-class domestic enterprises with global competitiveness, Wu said.

Meanwhile, there is statistical proof of the efficacy of overseas expansion as a means of boosting a company's profile on the global stage. For instance, the number of Chinese companies listed in the Fortune 500 list this year has risen to 61 from 16 in 2005. Sinopec Group ranked fifth in the Fortune Global 500 in 2011, up from seventh in 2010, while China National Petroleum Corp (CNPC), the country's biggest oil producer, ranked sixth this year from 10th a year ago.

In October, Jiang Jiemin, CNPC's chairman, said that the next few years will see the company continuing its overseas expansion. Canada and Australia will become the main focuses of attention because of their abundant natural resources and sound investment environments. Jiang said his company's overseas oil and gas output is expected to hit 100 million tons of oil equivalent in 2011, compared with 86.73 million tons last year.

CNPC's listed arm PetroChina Co Ltd joined Royal Dutch Shell PLC in 2010 in buying the Australian coalbed gas company Arrow Energy Holdings Pty Ltd for $3.2 billion. PetroChina had also planned to buy a 50 percent stake in Canada's Encana Corp, but the deal collapsed in June.

CNPC's rival, Sinopec, also accelerated the pace at which it acquires assets by purchasing Canada's Daylight Energy Ltd for $2.16 billion in October. The company became more aggressive in the global markets after Fu Chengyu, the former chairman of CNOOC, took the helm at the company. Fu was appointed chairman of Sinopec in April. The appointment was widely seen as part of a central government plan to accelerate Sinopec's overseas expansion through Fu's vast experience in overseas M&A, gained during his tenure at CNOOC.

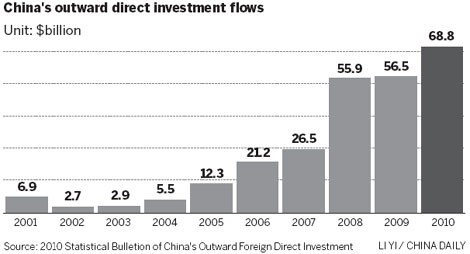

According to officials at the Ministry of Commerce, China's outbound direct investment (ODI) will grow by 30 percent every year and will exceed foreign direct investment within three years. Figures compiled by the US Asia Society estimated that China's overseas assets through ODI may reach $2 trillion worldwide by 2020.

The US, the European Union and Latin America will receive the bulk of Chinese investment in the next few years, according to Zheng Chao, commercial counselor at the ministry's department of outward investment and economic cooperation, speaking in May.

For Chinese oil companies, the unconventional natural gas resources in Canada and Australia as well as liquefied natural gas (LNG) resources in Australia will be the major prizes, said Wu Mouyuan, a researcher at the Overseas Investment Environment Research Department of CNPC's research unit.

Wood Mackenzie Ltd, an energy information provider, projected that Chinese demand for gas will remain high until 2017, growing at a compound annual rate of 18 percent, from 136 billion cubic meters (cu m) to 284 billion cu m. The abundant and untapped oil and gas resources in Latin America will also be a major draw for Chinese oil giants, analysts said.

China's rising economic status in the world will help the country play a significant role on the global stage, said E&Y's Wu. However, she warned that Chinese companies will also face challenges in their attempts to grow internationally, including cultural differences, language barriers, financing difficulties, and policies enacted by overseas governments.