China's US Treasury stock at 16-month low

Updated: 2012-01-20 10:14

By Wei Tian (China Daily)

|

|||||||||

|

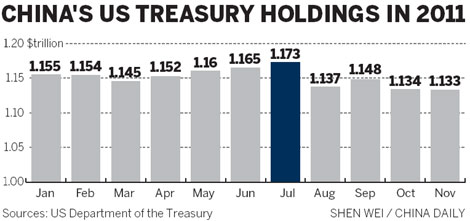

China made six monthly cuts of US debt in 2011, data from the US Treasury Department show, trimming its holdings by $27.5 billion from the end of 2010. [Photo/China Daily] |

Country encouraged to put money into alternative varieties of assets

BEJING - China cut its holdings of United States Treasury bonds to the lowest level in 16 month in November in a step that analysts said was meant to continue the diversification of the country's foreign exchange reserves amid global uncertainties.

According to data from the US Treasury Department, China's holdings of US Treasury bonds stood at $1.1326 trillion by the end of November 2011, $1.5 billion down from the previous month. It was the second successive month that the amount had declined, and the lowest reserve level seen since July 2010.

China made six monthly cuts of US debt in 2011, the department's data showed, trimming its holdings by $27.5 billion from the end of 2010. Yet despite the reductions, China remains the top buyer of US Treasury securities.

Meanwhile, a surge in international demand pushed up the amount of foreign holdings of US Treasury debt by 1.7 percent in November to hit $4.75 trillion.

Japan remains a strong net buyer of US Treasury bonds, bringing its holdings of the securities to a record high of $1.039 trillion and threatening China's position as the top holder. Britain, the third largest holder of US Treasury debt, also increased its holdings by 4.4 percent to reach $429.4 billion.

"The 'risk-aversion' sentiment caused by a deteriorating eurozone crisis has prompted the demand for the government bonds issued by developed countries, such as the US," Dagong Global Credit Rating Co, a Chinese rating agency, said in a research note.

"However, this does not imply the improvement of solvency in these countries, but only the limited investment choices under the current international monetary system."

Dagong predicted that the US' debt-to-GDP ratio may continue to rise to 105.8 percent in 2012 from 100.7 percent in 2011. And the US Federal Reserve is likely to launch a third round of quantitative easing - injecting more money into the economy - in the middle of the year.

In December 2011, China's foreign exchange reserves declined on a quarterly basis for the first time in more than a decade, falling to $3.18 trillion, according to data from the People's Bank of China, the central bank.

"Although declining, the (foreign-exchange) reserve is still huge," Zhou Jingtong, a researcher with Bank of China Ltd, was quoted by China Business News as saying.

"Diversifying the portfolio and moderately reducing dollar assets is the only choice in the long term."

Investing in US Treasury bonds is "relatively safe" at the moment but is definitely not the best step to take, Zhou said. He said the chances are good that the securities will depreciate.

"Diversifying foreign reserves calls for varying the types of currencies and also diversifying assets," said Mei Xinyu, a senior researcher at the Ministry of Commerce's Chinese Academy of International Trade and Economic Cooperation.

Mei said the Chinese government should concentrate more on holding diverse classes of assets - by, for instance, investing in the US stock market or in stocks in other countries.

- Car-rental firm wants to use IPO to expand

- Local pension funds aim to tap financial sector

- Industrial output growth set to slow down

- China cut US Treasury stock

- BMW recalls Mini Coopers in China

- China Unicom 3G users top 40m

- Housing sales fall 15% in major S China city

- China publishes first industrial restructuring plan