2011: Slowest growth in a decade for light vehicle market

Updated: 2012-01-30 10:05

By Jenny Gu (China Daily)

|

|||||||||

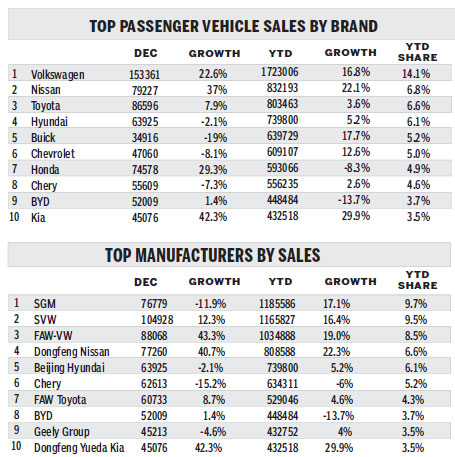

Heated competition in battle for market share

China's light vehicle market finished 2011 with 18 million new vehicles sold to edge up 4.6 percent from 2010, the lowest annual growth rate in the past decade. Despite the slowdown, China maintained its position as the largest light vehicle market in the world for the third consecutive year.

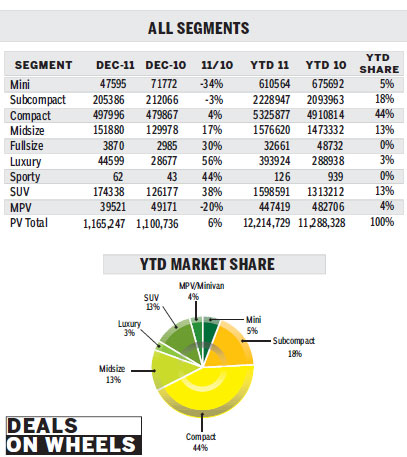

Demand for passenger vehicles increased 9.6 percent year-on-year to 13.1 million units. But light commercial vehicle sales saw a 6.7 percent decline from 2010 with sales totaling just 4.9 million units.

|

|

The December seasonally adjusted annual rate of 19 million units was on par with November. Some automakers increased their wholesale volumes in December to prepare for strong sales over the Chinese New Year holiday.

SUVs and luxury cars performed well, showing 20 percent year-on-year growth.

Other passenger vehicle segments such as subcompact and compact cars are maturing and showing growth rates in line with the overall market.

More new models went into emerging growth segments than into maturing parts of the market. A total of 17 new models were added in the SUV segment while only 15 new compacts and subcompacts were introduced.

We see different competitive environments in different segments.

|

|

In the emerging segments, the traditional share held by big sellers is consistently being eaten away by the new entrants. But in the mature segments, the leading brands are bolstering their positions.

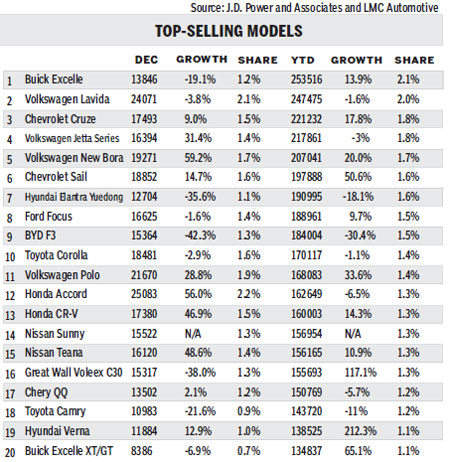

For example, leading brands in the compact and subcompact segments, VW and Chevrolet, gained market share. However, Toyota and Audi, the top brands in the SUV and luxury car segments, lost share to other brands.

The moderate growth rate in 2011 is quite different from the heady growth of 2009 and 2010, when manufacturers didn't have time to think about the market or customers, but just getting vehicles into the showrooms. In those years, most automakers achieved growth without much effort. In 2011, a year of adjustment, some achieved growth but others didn't.

Only those who really made efforts to understand the market and customers expanded their share in 2011.

Take Shanghai GM and Shanghai VW, for example. Both companies worked hard accumulating market knowledge, helping them to draw up effective medium and long-term strategies. They also implemented a sophisticated monitoring tool to track the market, enabling them to adjust their short-term strategy dynamically. This is exactly the kind of weakness seen in many of the local brands, which lack market knowledge and apply inconsistent strategies.

The end of tax incentives and subsidies is often used as a reason for the poor performance of domestic brands. However, we believe that is not the root cause.

For instance the Chevrolet New Sail subcompact. Shanghai GM's cheapest car took share from some local brands under the same market conditions without incentives or subsidies.

Price-conscious as they are, customers in the segment chose the New Sail instead of local branded cars because the model met their needs. Shanghai GM achieved this through a large amount of customer research and competitor analysis.

|

|

Looking forward, the impact of governmental support policies will eventually fade away and the market will grow organically.

Local brands have been rushing into the SUV segment, given the large growth prospects, without taking into account what customers actually need. They may be able to earn market share in the first few years as the SUV remains an emerging segment, but they will finally lose out to those who understand the market better when the segment matures.

We expect the light vehicle market to expand 9 percent to 19.7 million units in 2012. Passenger vehicle sales are projected to reach 14.5 million units, up 11 percent from 2011.

It will be a better year for Chinese brands but still not an easy one. Restructuring and repositioning is likely to become the theme for the top three manufacturers - Chery, BYD and Geely.

For smaller brands, such as Great Wall, JAC and Chang'an, it is more crucial to set up a strong brand image and roll out star models.

The author is a senior analyst at J.D. Power and Associates and LMC Automotive, who can be reached at jgu@lmc-auto.com

Related Stories

China's homegrown low-floor light rail vehicle passes tests 2010-12-08 16:14

China-related markets seeing light at end of tunnel 2011-04-28 06:44

Faster than light- Is this claim trustworthy? 2011-09-24 09:52

Harbor lights fantastic 2010-12-19 08:51

- Property tax cools high-end housing market

- Real estate down under is very attractive

- Sino-US trade tensions may increase

- Surging new loans calls for another RRR cut

- Home appliance sales cool off

- Top auditor warns of fiscal, financial risks

- Call to adjust interest rates

- Real estate funds expected to rise