|

|

|

|

||||||||||||||

|

|||||||||

Market reforms

Huang Zemin, head of the International Financial Research Department of East China Normal University in Shanghai, said that reform of the capital market is a precondition for investment of the pension fund. Listed companies need to improve both the transparency of information and the delisting mechanism for those on the verge of bankruptcy, as well as reforming the procedure for IPO issuance to make it more market-oriented, said Huang.

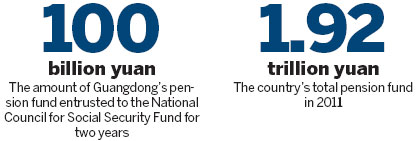

Dai Xianglong, chairman of the NCSSF, said that the pension fund will insist that any investments should be long term, rather than simply short term and speculative. His organization manages about 800 billion yuan in social security funds, raised in part from the sale of shares in State-owned companies and also by central government grants. Over the past 10 years, its investments in equities and corporate and government bonds have realized an average annual rate of return of 9.17 percent, easily outstripping the country's average annual inflation rate of 2.14 percent over the same decade.

The pension fund can achieve a higher return from the share market than from fixed-income instruments, providing that the investment decisions are rational, Dai said.

However, Ye Tan, a noted financial columnist who writes for several news outlets, said the transparency and efficacy of the NCSSF's investment might not be easily duplicated by local pension funds, which are managed by what she refers to as a "black box system", because of the lack of transparency.

In 2006, several members of the Shanghai municipal government, including the local Party chief Chen Liangyu, were dismissed from their posts after it was discovered that roughly 3.2 billion yuan of local pension funds had been embezzled and used to finance a series of projects ranging from real estate development to roads.

"I'm afraid that those who support the move to give pension funds more access to the capital markets are not telling the whole story," said Ye. "The record of pension fund misuse at the local level makes it unclear whether investment of the fund will generate any real public benefits."

On Monday, the Ministry of Finance issued a notice reiterating a ban on local governments making any investments, direct or indirect, with pension funds, other than the purchase of government bonds or depositing the cash in savings accounts.

'Empty accounts'

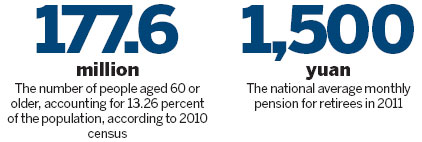

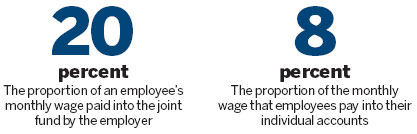

China started its pension system in 1997, combining joint social funds with individual accounts. The system is designed to allow the State to pay pensions with money collected from the younger generation: Employers pay the equivalent of 20 percent of an employee's monthly wage into the joint fund, while the employees themselves pay about 8 percent of their monthly wage into their individual accounts. The original plan was to pay pensions from the joint fund, while the money in individual accounts was to be managed and invested for future use.

However, the process has proved costly. The country is still in the process of increasing pension coverage and the amount received by retirees has been raised several times during recent years, meaning that the government has had to use money from individual accounts to cover the expense, resulting in a large number of "empty accounts" (accounts with no money), according to Zheng.

In 2004, the Ministry of Labor and Social Security (later renamed the Ministry of Human Resources and Social Security) announced that the individual accounts had a deficit of 740 billion yuan. Those are the only official statistics available, but Zheng Bingwen from the CASS has estimated that the current scale of empty accounts is 1.3 trillion yuan, despite a decade of, largely unsuccessful, attempts to refuel them through government subsidies.

Northeast China's Liaoning province, for instance, faced a pension shortfall of 14.65 billion yuan in 2010 and had to borrow money from individual accounts, despite receiving an annual central government subsidy of 1.44 billion yuan since 2001.

Although some analysts argue that it is not unusual to see "nominal accounts" - that is, pension funds devoid of real cash - in other countries, the huge deficit should set alarm bells ringing and prompt China to reform the existing pension fund management system to support the growing number of elderly people in the coming decades, said Zheng.

In 2010, each pensioner was supported by the combined contributions of five workers, but by 2020 three workers will have to provide the funds, further increasing the tax burden and potentially storing up another problem that will have to be dealt with by future generations.

Contact the reporters at lij@chinadaily.com.cn and chenjia1@chinadaily.com.cn