|

A stone lion sculpture in front of the Bank of Guangzhou. The March lending rise is consistent with the policy easing and support that have been signaled by the Chinese government from the beginning of this year, according to experts. [Photo/China Daily] |

Expanding demand for credit behind the rise, sending strong positive economic messages

Some experts believe a new round of easing is under way because of the slowdown in economic growth and declining inflation but is it really a good time to change the "prudent" monetary policy stance, or has it already been carried out?

According to the People's Bank of China, the outstanding broad money supply (M2), which covers cash in circulation and all deposits, rose 13.4 percent year-on-year by the end of March, from 12.4 percent in January.

|

|

The money supply has been increasing for three consecutive months. Most analysts believe the increase is reasonable and in line with economic growth and prices.

"The rebounding figures were a result of expanding credit demand as more factories began production after the Spring Festival, as well as greater credit, since the banks absorb more deposits at the end of a quarter," said Zhou Wenyuan, a senior analyst with Guotai Junan Securities.

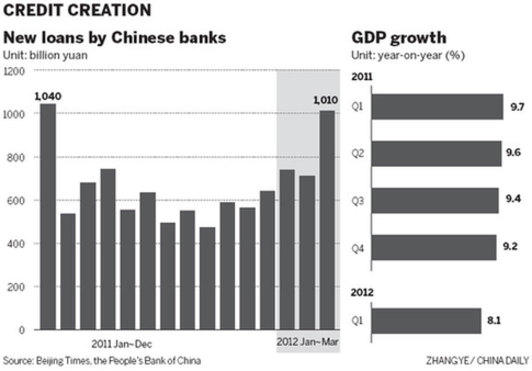

According to the central bank's data, new loans in the first quarter amounted to 2.46 trillion yuan ($390 billion), an increase of 217 billion yuan year-on-year. New loans in March hit a 14-month high of 1.01 trillion yuan.

Meanwhile, deposits in March were 2.95 trillion yuan, 271.2 billion more year-on-year.

But considering the seasonal factors, the M2 growth speed may retreat again in April, Zhou said, adding that the extent of the decrease depends on the monetary tools that will be adopted.

"The money supply will maintain moderate recovery in case there is another bank reserve cut. However, considering the stringent macro policy and decreasing foreign purchases, the M2 is not likely to experience a sharp increase," he said.

Overall, the credit growth figure in March has sent positive signals, but the structure of the credit suggested that investment demand in the real economy remains weak, according to a report by Pingan Securities.

The long-term loans only accounted for 26.7 percent in the new loans in March, the lowest level since 2006, suggesting most of the new loans are being used to address liquidity rather than being invested in the real economy.

Meanwhile, a slower growth in M1 than the M2 indicated that companies and residents are tending to save more instead of investing or spending.

Despite the authorities espousing they are adopting a "prudent" monetary policy stance, some analysts believe de facto easing is already under way, since "the Q1 money supply figure was obviously not a 'prudent' one", said Zhou Junsheng, a financial commentator.

The easing monetary policies in response to the global financial crisis in 2008 remain fresh in the memory. Credit was close to 8 trillion yuan and was widely criticized for causing surging house prices and inflation.

"However, the credit scale this year will definitely exceed that of 2008 if the growth pace maintains its current pace, even if the policy stance has been labeled 'prudent'," Zhou said.

Sun Lijian, a professor with Fudan University, said if the real economy could not absorb the expanded liquidity, there are risks that raw materials and consumer goods will again become victims of speculation, which will push up inflation while hindering production and economic growth.

The growth of M2 in the first quarter was still lower than the year-round target of 14 percent set by a government work report in early March.

|

|

As a result, some analysts believe growth in M2 will continue to accelerate because the banks were encouraged to provide more credit aid to in-construction projects, smaller businesses and affordable housing.

The 1.01 trillion yuan of new credit in March exceeded much of the market expectations of around 800 billion, even the optimistic estimates of Wang Tao, chief economist with UBS AG.

"The worries over a slowing Chinese economy mostly concerned weak credit growth but the easing signals were reflected within the figures," said Wang

Wang estimated that the growth in new loans will further increase to 2.3 to 2.4 trilliion yuan in the second quarter, which will lead to more fixed investment and will drive up the monthly growth in gross domestic product.

weitian@chinadaily.com.cn