Sovereign wealth fund suffers worst performance since 2008, report says

China Investment Corp, the country's sovereign wealth fund, reported an annual loss of 4.3 percent in its overseas investment portfolio in 2011, due largely to the sluggish global economy.

It was the first loss since 2008 when the financial crisis hit, the company said in its annual report on Wednesday.

|

"Like many major sovereign wealth funds and global institutional investors, overseas investment was affected by an overall downturn in the global market," CIC spokesman Wang Shuilin said at a news conference in Beijing.

A case in point is Singapore's sovereign wealth fund, which has seen profits shrinking by 16 percent in the last fiscal year, with annual returns down from 4.6 percent to 1.5 percent.

CIC Chairman Lou Jiwei said the global economy remains in a fragile state.

"CIC will adhere to its prudent investment approach," and achieve good financial returns within acceptable boundaries of risk, he said in the preview of the annual report.

Total assets of CIC at the end of last year, including Central Huijin Investment, stood at $482 billion, 17.7 percent up from the previous year. The company reported a net profit, for domestic and overseas investments, of $48.4 billion, down 6 percent year-on-year.

Investment returns in 2010 reached 11.7 percent and cumulative annualized returns stood at 3.8 percent since CIC was established in September 2007.

The loss in investments, according to Wang, was mainly attributed to the fluctuating value of a number of assets, especially in the financial and energy sectors, the two largest components in the portfolio.

Financial assets accounted for 19 percent of investments and energy accounted for 14 percent.

Meanwhile, "some of the projects CIC invested in are still at the early stages," and these will mature, Wang said.

According to the report, CIC stressed its long-term vision by extending its investment horizon from 5 to 10 years last year. The company made adjustments to its asset allocation accordingly.

Long-term investments account for 31 percent in its global investment portfolio.

CIC also adjusted its organizational structure in 2011 by establishing CIC International, which specialized in the management of overseas investments. In December, $30 billion was injected into CIC International in a bid to enhance its role as a vehicle to diversify foreign exchange holdings.

China's investments overseas remain promising in the long term, experts said.

Ding Zhijie, dean of the School of Banking and Finance with the University of International Business and Economics, said direct equity investment may be a better option than financial assets in the long term.

"Returns on equity investments will eventually turn positive as their value increases when the global economy improves," Ding said.

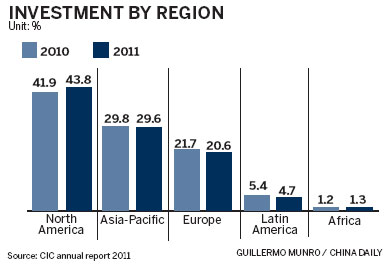

CIC has also reduced equities in Europe by 1.1 percentage points to 20.6 percent by the end of 2011, while assets in North America picked up by 1.9 percentage points to 43.8 percent.

In a June report, Lou was quoted by the Wall Street Journal as saying that CIC was lessening its exposure to stocks and bonds in the European market because of the eurozone crisis.

CIC reduced the proportion of its fixed income investment from 27 percent in 2010 to 21 percent in 2011.

"The selling of fixed-income investments showed that CIC has already adopted some measures to help lessen the losses," said Xu Hongcai, a senior economist with the China Center for International Economic Exchanges. Wang said although the company has lessened its investment in government bonds in Europe, the latest downgrade by Moody's Investors Service means that a depreciation of European equity assets is posing opportunities in direct investments.

However, Ding denied that purchases in euro assets were a good option, as the European crisis has not yet hit bottom. "China still needs to diversify its assets," he said.

And both policy makers and businesses in Europe are eyeing investment from China.

Karel de Gucht, the European trade commissioner, said doing business with China is one of the main ways to deliver growth in the eurozone.

Engagement with China should be more pragmatic, he said, pointing out that fear of Chinese investment among some Europeans is wrong.

"On the European side, there is too much emphasis on fear. This is simply misguided," he said recently in London.

In a news conference about investment opportunities related to the Olympics, an official from the UK trade ministry said that China is one of the most important sources of foreign direct investment to the UK.

He cited CIC investing in Thames Water this year as a good example.

The UK government will host a China Day this week as it looks to attract more investment. The event, which aims to connect British businesses with Chinese investors, was almost fully booked nearly one month in advance, according to a spokesman.

Contact the writers at weitian@chinadaily.com.cn and diaoying@chinadaily.com.cn