Liu Yuqi, 58, a retired teacher, has moved part of her deposits from a major State-owned lender to the Bank of Nanjing for the better interest rate, although her son sneered at her enthusiasm about finding a "tiny" difference.

Like Liu, 1.3 billion Chinese, well known for their saving habits, got different rates to choose from after the central bank in June allowed lenders to price deposits higher than benchmark rates for the first time.

They don't have many alternatives, as prices were divided into two camps - 1.1 times the benchmark offered by joint-stock and smaller lenders, and 1.08 times the benchmark priced by major State-owned banks - but "it can be a good start", Liu said.

A senior executive surnamed Li at the Beijing branch of Bank of China Ltd. acknowledged that the difference in rates is miniscule.

"Most of the depositors are still waiting to see what will happen next because the current difference in rates is too small. For now, we haven't seen a lot of deposit draining," Li said.

The People's Bank of China in June gave lenders permission to set deposit rates up to 1.1 times the benchmark rates.

Thirsty for capital, small and medium-sized lenders set their rates for deposits to the ceiling immediately after the formal announcement went into effect, while major State-owned banks were more conservative, setting the deposit rates at 1.08 times the benchmark rates.

Savings started to drain from banks as wealth management products, funds and trust businesses grew in popularity with depositors. This year, two of the first five months have witnessed year-on-year declines of deposit increases among commercial lenders.

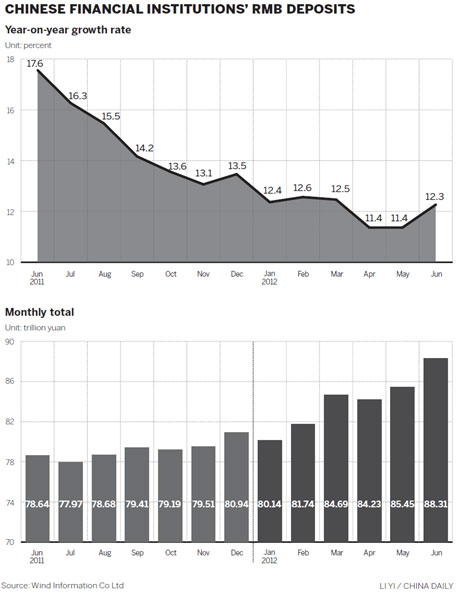

In the first half, outstanding yuan deposits stood at 88 trillion yuan ($13.82 trillion), up by 12.3 percent year-on-year. The pace was 1.2 percentage points lower than six months earlier.

While money paid for deposits increased, banks' interest rates for loans are facing downside pressure as lower limit of lending rates was reduced twice.

Banks were also allowed to set the interest rates charged on their loans at or above 80 percent of the government's benchmark rates, down from the previous 90 percent.

Later in July, the central bank further reduced the lower limit of lending rates to 70 percent of the benchmark rate, but leaving the upper limit of deposit rates untouched.

Li Daokui, a former adviser to the central bank's Monetary Policy Committee and a professor at Tsinghua University, said earlier that more expansion of the allowed range around the benchmark rates will follow.

Morris Li, president of China Guangfa Bank Co Ltd, said the timing of such moves was "very smart", although the liberalization came earlier than expected.

"Freeing rates while cutting them grants a buffer to the lenders as well as clients so that they could have more time to get adjusted," Li said.