A forced move

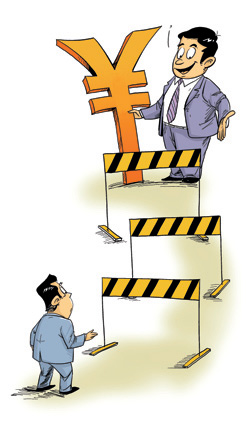

Shadow banks are a reaction to China's financing restrictions and tight monetary policies. While the financing environment benefits government-background companies, many private firms, especially small and micro-sized ones, are ruled out of the lending decisions of banks, said Huang Yiping, a professor in economics at Peking University, in a paper titled Will China's Shadow Banks Be Another Subprime Mortgage Crisis?

Small and medium-sized enterprises are never the main clients of commercial banks in China and banks have a high financing threshold for them. In the past several years, China has stuck to prudent monetary policies, which intensified the cash-strained situation for SMEs.

In 2011, only 21 percent of SMEs managed to borrow money from traditional lending financial institutions such as banks and rural credit cooperatives, and around 20 percent of them have never borrowed any money, according to a survey jointly conducted by Peking University and the Alibaba Group in East China's Zhejiang province.

|

|

Yu also said that the dramatic increase of shadow banks in China is partly the result of an overly rigid financial system.

"Serious defects in traditional financial institutions, especially banks, have made it very difficult for the real economy, and SMEs in particular, to get enough financing," said Yu. "That's why financing offered by non-bank financial institutions has taken off in China over the past several years."

Supervision is key

Scrutiny of the shadow banking system has increased since the outbreak of the subprime mortgage crisis in the United States in 2008.

"Appropriate monitoring and regulatory frameworks for the shadow banking system need to be in place to mitigate the build-up of risks," said the FSB report.

"There is still a vacuum of supervision in China's shadow banking system," said Yu. Some transaction activities in China's shadowing banking system don't receive much scrutiny, such as guarantee companies and micro-credit companies. They are not within the supervision of the PBOC and the CBRC but are subject to oversight from regulatory bodies specified by local governments.

However, financial supervision is quite specialized field, and letting non-specialized local governments supervise them is far from enough, he said.

"This is the key reason for the rampant expansion of micro-credit companies, guarantee companies, loan sharks and illegal private banks in recent years," said Yu.

"Despite the possibility of facilitating efficiency and economic growth, the shadow banking system is a high-risk business that needs stricter regulation and supervision," Huang said. Several steps are needed to contain the risks posed by China's shadow banking sector.

First, in the short run, supervisory bodies should formulate more rules and regulations for companies that are engaged in the shadow banking system. Second, a clear supervisory framework must be designed to manage this business. Finally, a deeper transformation of China's financial system must be made, including a market-oriented interest rate regime. This will enable more companies to gain financing from banks and China's capital markets, said Huang.

While further oversight is necessary, Shang said, regulations should be formulated based on the specific qualities that make up China's shadow banking system.

"For the next step, the CBRC will further study the functions, scale, structure and risks of the shadow banking system in China, based on the actual reality in the shadow banking sector," Shang said.

"Also, we will promote further bank reform and innovation to offer better and safer financial services," he added.