High-quality assets available as West struggles with economic crisis

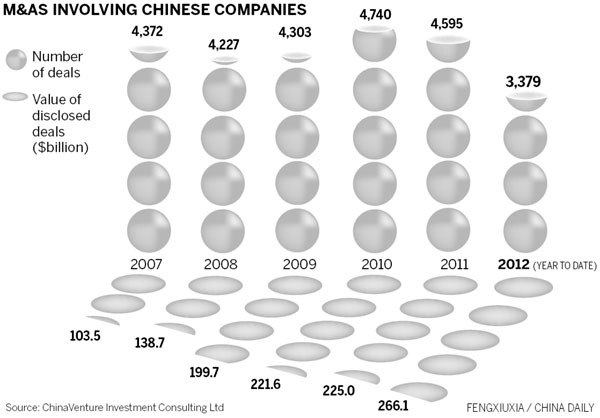

Outbound merger and acquisition deals by Chinese companies are expected to increase next year, a report said on Wednesday.

Due to the eurozone debt crisis, many high-quality assets have became available in Europe at competitive valuations, so Chinese companies have been active in large-scale M&A deals since 2011, said a report by Chinese research firm ChinaVenture Group.

The main sectors for M&A activity are expected to be energy, engineering machinery and infrastructure, which require significant funds and policy support. Chinese companies in these sectors are expected to increase their M&A activity next year, ChinaVenture said.

"China has a huge demand for energy and is going abroad to seek opportunities," said Wan Ge, author of the report and an analyst at ChinaVenture.

"Usually, Chinese buyers are State-owned enterprises so the trade value of these deals is considerable," Wan said.

M&A deals by Chinese companies linked to their own industry sector are also becoming increasingly popular.

In September, Lenovo Group paid 300 million reais ($144.10 million) in both cash and shares to acquire CCE, Brazil's largest domestic electronics maker. And in October, Lenovo invested 115 million euros ($151.65 million) in German consumer electronics company Medion AG for a 17.32 percent stake.

Meanwhile, as private companies require funds to go abroad for M&A deals and face some obstacles when they try to get loans from banks, venture capital and private equity firms will play a more important role in helping these companies - as well as the State-owned ones - in the next few years, said the ChinaVenture report.

For instance, Sany Heavy Industry Co and Citic PE Advisors paid 360 million euros this year for concrete-pump maker Putzmeister Holding GmbH to add technology know-how and expand overseas.

Additionally, as of Dec 21, 837 Chinese companies were waiting for their initial public offering, or IPO, applications to be reviewed. Since many of them are backed by venture capital and private equity firms, M&A deals are expected to be an important way for those VC and PE firms to exit their investments next year.

"Nowadays, as the United States stock market is chilly, the IPO channel for investment exits has been blocked somewhat. For VC and PE companies, M&A deals are an effective way to exit their investments," said Xiong Xiaoge, a founding partner of VC firm IDG Capital.

Special Coverage

Related Readings

Chinese companies' cross-border M&A rising

Deloitte: China's outbound M&As to keep rising

China's cross-border M&As climb