China's market potential has attracted a growing number of multinationals seeking M&A deals in a wide range of sectors, including the machinery, manufacturing, medical care and retail industries, reports Liu Jie.

|

|

|

US-based medical device provider Medtronic's stand at a medical equipment exhibition in Beijing. The company acquired China Kanghui Holdings, an orthopedic devices manufacturer, for $816 million in cash in September. Wu Changqing / For China Daily |

Medical-device maker Medtronic Inc has recently announced two acquisition deals of Chinese companies, with the two deals worth nearly $900 million.

The United States-based company said at the end of September that it would acquire China Kanghui Holdings, a Jiangsu-based maker of orthopedic devices, for $816 million in cash. The deal was completed in mid-November.

In October, Medtronic - the world's largest maker of pacemakers - said it would buy a 19 percent stake in the Shenzhen-based LifeTech Scientific Corp for $46.6 million, with a $19.6 million convertible note representing an additional 7.4 percent stake.

LifeTech makes devices for minimally invasive surgeries for cardiovascular and peripheral vascular diseases and disorders.

Medtronic said that the acquisitions will help advance its globalization strategy, as well as expand its local presence and accelerate its access and competencies in China.

Like Medtronic, many international companies are showing their interest in boosting their M&A activity in China.

"Given the macroeconomic conditions globally and domestically, a transaction volume increase shows that multinational giants still have financial ability to do M&As, and Chinese companies are attractive to foreign buyers given their production strength as well as their marketing, and research and development resources," said Chen Fengying, director of the World Economics Research Center of the China International Economic Relation Research Institute.

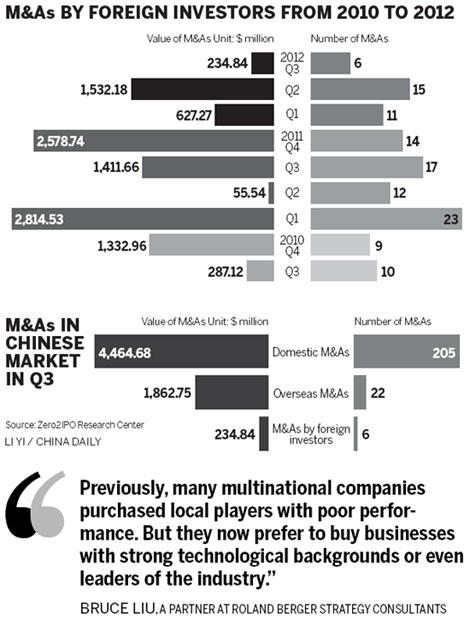

According to Zero2IPO Research Center, a domestic research firm, during the first nine months of the year, the number of foreign companies' acquisitions in China dropped. M&A deals decreased to 32 during the first three quarters of the year from 51 a year earlier.

However, the average transaction volume of each deal increased to $141 million from $132 million.

Thomson Reuters data show that during the first half of the year, the deal volume of global M&As amounted to $1.1 trillion, down 21.5 percent year-on-year.

Related Readings

M&A deals become scarcer in Jan-Nov

China domestic M&A volume at record high in 2012

M&A approval process to be more transparent

M&A cools in China, heats overseas

Property market likely to see more M&A

M&A reviews to be given new fast-track procedure

Top 10 Android game publishers in China

Top 10 Android game publishers in China

Antique cars, typewriter and telephone on display in Shanghai

Antique cars, typewriter and telephone on display in Shanghai

Top 10 largest consumer goods companies worldwide

Top 10 largest consumer goods companies worldwide

Mermaid fantasy spurs business opportunities

Mermaid fantasy spurs business opportunities

Top 10 2016 Red Dot Award winning car makers

Top 10 2016 Red Dot Award winning car makers

Offbeat entrepreneurs in Beijing's hutong

Offbeat entrepreneurs in Beijing's hutong

Top 10 Chinese internet companies

Top 10 Chinese internet companies

Fun time for children at international toy expo in Beijing

Fun time for children at international toy expo in Beijing