|

|

|

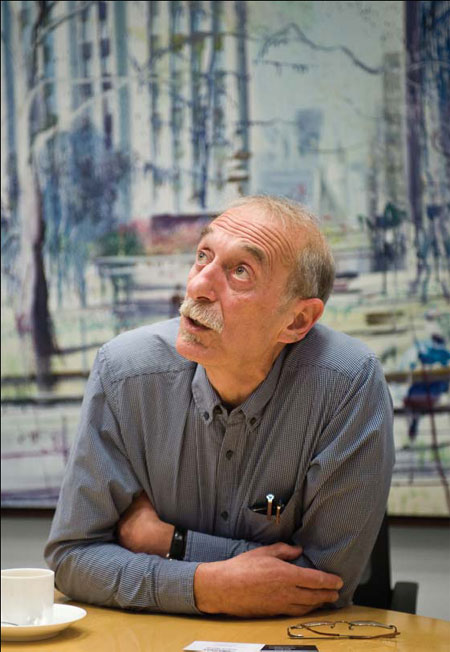

George Magnus of UBS says it takes 10 years to overcome a systemic finanical crisis. [Photo/China Daily] |

"I am not sure what the grounds for optimism are. I expect the region to contract by 0.5 percent for the year but in three or four months time, I wouldn't be surprised if this has to be revised downwards."

In China, inflation is one key indicator that is tracked since any signal that prices are rising is usually followed by a policy response. The CPI index was again on a rising trajectory in November at 2 percent, following on from a 33-month low of 1.7 percent in October.

Williams at Capital Economics expects inflation to rise around the time of the Spring Festival holiday in February.

"We could see some eye-catching figures around the Chinese New Year when inflation could again be back up to 4 percent but I think it will come off that to 3 percent for the year as a whole."

Ballim at Standard Bank also thinks inflation is heading upward in China and will be more than double its current level by the end of the year at around 4 percent.

"I think it is an uncomfortable directional trend but I don't expect the authorities to take punitive measures because of the backdrop of the global recession," he says.

Most of China's restrictive measures have focused on the property market, which can sometimes be the runaway engine of the China economy.

Miranda Carr, head of China research at NSBO, the strategic investment research company based in London, estimates that real estate makes up around 12 percent of GDP.

"It is not just industries like furniture but also advertising with real estate advertising being a significant proportion of the whole (advertising) industry," she says.

"One of the reasons why growth was slow in 2012 was that the real estate market was operating under restrictions. We saw one of the biggest pick-ups in real estate investment in November to 28.5 percent year-on-year and this could continue into next year (2013)."

Brice at Standard Chartered Bank is also optimistic about the China property market.

"The big picture is that we are expecting the property market to stabilize and move higher again. The fundamentals for most of the China residential property market remain fairly robust," he says.

One of the weakest aspects to China in 2012 was its stock market with investors preferring to benefit from the China growth story by investing in international companies exposed to China than in those listed on Shanghai.

Rieschel expects a major bounce back from the 46-month low in November to much healthier territory.

"I expect the Shanghai index to increase by 20 percent this year and I wouldn't be surprised if it hit 3000," he says.

"The underperforming nature of the Shanghai market is often about the poor quality of the financial informational available as well as (the capability of) analysts and there is more robust work to be done in this area."

Related coverage:

More stories:

New Year resolutions on economy