Global economic woes have boosted outbound mergers and acquisitions by Chinese companies to a new high in 2012, reports Du Juan.

China's outbound mergers and acquisitions reached a record high in 2012 as companies and investors continued to seek opportunities abroad, especially in the energy and resources sectors.

The country's total outbound M&A volume was $59.7 billion from January to Dec 13, up 23 percent from the previous year, and accounted for 7 percent of the global cross-border M&A volume in 2012, according to statistics from Dealogic Holdings PLC, an international financial-data provider.

|

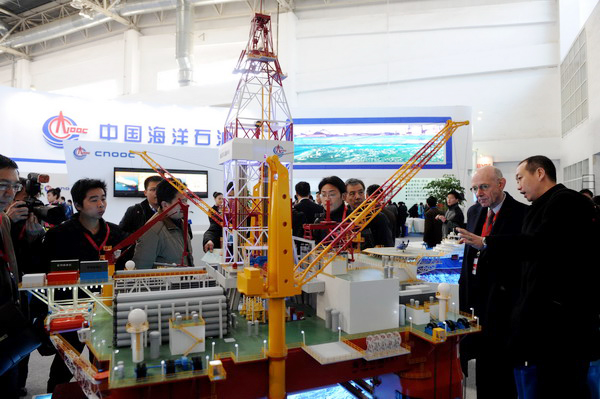

A drilling platform developed by CNOOC Ltd, China's largest offshore oil producer. The Canadian government earlier approved the Chinese company's acquiring Canadian energy counterpart Nexen Inc. The volume of China's outbound M&As in the oil and gas industry reached $34.5 billion with 35 deals by Dec 13, 2012. [Photo / China Daily] |

In contrast, China-targeted M&A volume fell 7 percent year-on-year to $167.1 billion this year.

"The weak global economy has provided Chinese companies a good chance to purchase foreign assets in order to expand their overseas businesses," said Lin Boqiang, director of the Xiamen-based China Center for Energy Economic Research. "The timing is good for overseas acquisitions, especially in the high-capital energy industry."

The bulk of China's overseas investments continued to be within the energy and resources industries, reflecting its growing appetite for raw materials.

The volume of China's outbound M&As in the oil and gas industry reached $34.5 billion with 35 deals by Dec 13. That was 55.5 percent of the overall deal volume, up 20.6 points compared with the previous year, according to data from Dealogic.

|

|

After the oil and gas industry, finance, mining, leisure and utilities were the top five target sectors for Chinese companies.

They spent up to $20.7 billion in M&A deals in Canada, which made it the largest target nation of China's outbound M&As for the first time in 2012, boosted by CNOOC Ltd's $18.2 billion acquisition of Nexen Inc.

"It is a trend for Chinese oil companies to buy more overseas assets," said Liao Na, information director at energy consultancy ICIS C1 Energy.

"The CNOOC-Nexen deal will help China get into the North Sea area, which will lead to gradually increasing participation in the international oil-pricing market."

More news on CNOOC Ltd

CNOOC oil fields in operation in South China Sea

Nexen CEO: CNOOC deal not yet done

China welcomes approval of CNOOC-Nexen deal

Timeline of CNOOC's bid for Nexen