Zhao Xu, a securities analyst with Northeast Securities Co, expects the operational conditions and net income for listed companies may remain on a steady growth track this year amid a recovery in the macroeconomy.

He forecast GDP growth may accelerate to 7.8 percent in 2013, supported by the remaining prudent monetary policy and proactive fiscal policy.

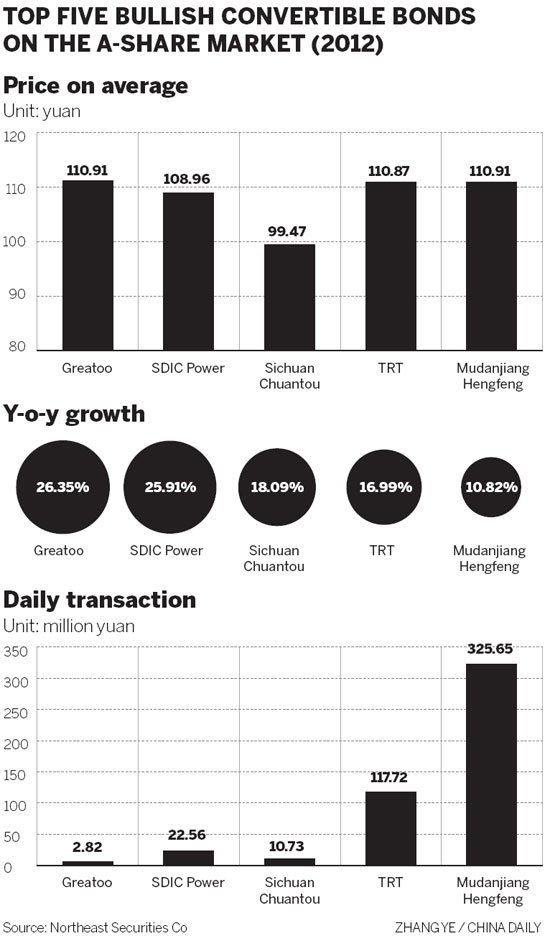

"The securities market is likely to turn bullish modestly in the first half and there will be more structural investment opportunities for convertible bonds," Zhao said. "The new leadership's determination for economic reforms and the urbanization policies will be a stimulus for the rebound of the securities market."

|

|

Chang Jian, an economist in China with Barclay's Securities, wrote in a research note that "urbanization can be a key driving force for the Chinese economy in the coming decade or two".

It will require more infrastructure and consumer goods and provide stronger growth momentum for the industrial and service sectors, she said.

Related to the convertible bond market, China's mainland stock market gained a cautious outlook from analysts this year.

"In the second half, it will be more stressful for the stock market and that will bring pressure to bear on convertible bond valuations," said Zhao.

The Shanghai Composite Index is likely to fluctuate between 2100 and 2600 this year, he predicted. The Chinese economy ended 2012 on a somewhat positive tone, with the Shanghai A-share index rising by 1.6 percent to 2269.13.

Besides the macroeconomy, the convertible bond market is also influenced by the bond supply-demand situation, said Xu from the CICC.

"The issuing pace for convertible bonds is likely to be slower than the market expectation in the first six months because the assessment value of the bonds is still at a low level," said Xu.

However, capital may increase faster in this market as the securities companies and fund management institutions including qualified foreign institutional investors are increasing convertible bond in their investment portfolios, he added.

chenjia1@chinadaily.com.cn

Year-ender: China's stock market

Stocks up on bullish China and US figures

China approves more QFIIs in 2012

Green sector buoys Chinese stocks

Ping An to issue $4.1b convertible bonds

ICBC to raise 25b yuan in convertible bonds