Shanghai index up 18% since late November

A sharp increase in newly opened stock trading accounts at brokerage firms over the past week could mark the early signs of small investors storming back to the market.

Data from China Securities Depository and Clearing Corp Ltd show that 117,600 new accounts were opened from Jan 14 to Jan 18, a 13.4 percent rise on the previous week, bringing the total number of active trading accounts to more than 12.6 million.

The benchmark Shanghai Composite Index has now risen 18 percent since late November.

While many stock analysts remain cautious about whether the rise marks the genuine return of a bull market, they report increased interest from individual investors, who are buying again in fear of missing out on bargains.

The Shanghai index fell slightly on Thursday, by 0.79 percent, or 18.31 points, briefly falling below 2300 around noon, before rallying to close at 2302.6.

The more significant number from the day, however, was that trading volumes increased 29 percent from Wednesday, worth a total of 135.6 billion yuan ($218.7 million), which was almost four times the average daily turnover since late November last year.

Chen Li, head of China equity strategy at UBS Securities Co Ltd, said the stronger-than-expected rebound over the past two months - which has dragged the index up from 1900 since early December - has raised the hopes of an army of depressed investors.

He predicted that "the bear market is over", and said he expected A shares to rise about 20 percent in 2013.

"The dynamic price-to-earnings ratio for 2012 didn't decline, an obvious sign that the bear market is ending.

"I expect 2013 to bring a small bull market. In fact, we've already seen that over the past month and a half."

Shaun Rein, managing director of China Market Research Group in Shanghai, said a series of recent financial and market data have shown China's economy is doing well, which has made him optimistic about the market.

He noted, in particular, that the property sector is expected to be strong over the next three years.

"That will pull up the economy and also boost the stock market," he added.

One private investor, Lin Xiaojun, 57, a retired school teacher, who has never owned stocks, told China Daily on Thursday his savings have been eroded by inflation, and that the stock market rally has given him what he considers his best chance of getting even.

"My friends have told me the bull market is here. So I want to get in early to make some money," he said.

However, one area still worrying experts is the performance of China's listed companies.

An examination by China Securities Journal earlier this month of the projected earnings released by China's 1,045 A-share listed companies revealed that 960 companies said their combined net profits are likely to range between 145.74 billion yuan, representing a 13.78 percent decline year-on-year, and 174.53 billion yuan, indicating only a slight rebound of 3.24 percent.

On Tuesday, the Ministry of Industry and Information Technology and 11 other government authorities announced plans to merge and restructure large enterprises, in a bid to cut down on wasteful competition, improve efficiency and enhance earnings quality.

The plan will involve 900 listed companies, with a total market capitalization of 4 trillion yuan.

xieyu@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

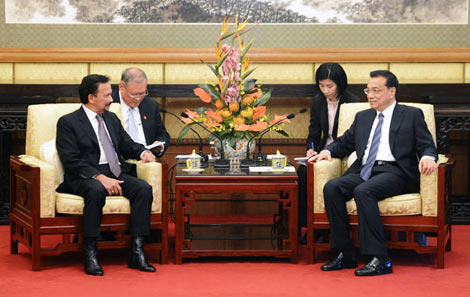

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show