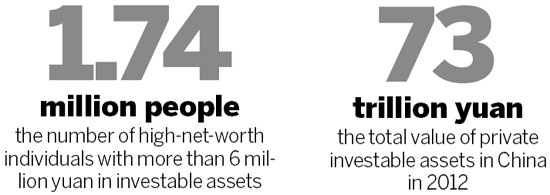

By the end of 2012, the number of Chinese high-net-worth individuals - those with investable assets of more than 6 million yuan - will reach 1.74 million, an increase of 17 percent from the end of 2011.

While the emerging affluent population in China provides more opportunities for wealth management business, the rigorous regulations also make it more difficult and challenging for investment banking businesses.

"In the past, two-thirds of UBS' entire capital was tied up within the investment bank, but it only contributed one-third of the group's overall profitability over the last two years," Weber said.

"In the future, investment banking will contribute the same amount to our overall profitability, but will only tie up roughly one-third of the bank's capital. So it is a much more efficient allocation"

|

|

In China, UBS has a multi-entity domestic platform, which allows it to develop its core businesses - wealth and asset management and investment banking.

UBS (China) Ltd supports the wealth management and credit and rates businesses.

UBS SDIC Fund Management Co Ltd is a joint venture with the State Development Investment Corp in which, for the first time, a foreign partner holds the maximum 49 percent equity stake.

UBS Global Asset Management (China) Ltd is engaged in domestic non-securities equity investment management and advisory services.

According to Weber, this year's capital market will be much better than the previous three years.

"We expect up to a 20 percent growth in the China equity market this year. If you look at the initial numbers that we started with this year, you've already have a good run in the first few weeks," Weber said.

For Weber, the core challenge UBS faces in China is how to maintain the bank's leadership position in the market.

According to financial services provider Dealogic, in 2012, UBS ranked first in core investment banking revenue for Asia excluding Japan and fourth for China.

It ranked second in completed mergers and acquisitions in China; and third in equity capital market bookrunning.

The bank participated in eight out of the 10 largest Hong Kong IPOs, of which all the issuers were Chinese companies.

"For our team in China, their task is about how to pick up speed now," he added.

huyuanyuan@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show