Central State-owned enterprises should avoid excessive investment in what might be considered non-core activities, but must remain open to alternative business opportunities as their own industries contract.

This's according to Xu Baoli, a director at the research center of the State-owned Assets Supervision and Administration Commission, who told China Daily that a degree of caution is still paramount in any investment.

During its annual conference, involving 118 central SOEs' heads in December, SASAC demanded companies look to both diversify, but also consolidate their activities in 2013, in an effort to combat the effects of the economic slowdown.

Strongly influenced by weaker foreign market demand and protectionism, central SOEs have seen profits drop since early last year.

Although fortunes started to recover since the second half of last year, thanks mainly to effective measures on cost reduction, overall profit growth inevitably slowed for the whole year.

According to the latest figures, total profits at central SOEs were 1.3 trillion yuan ($209 billion) in 2012, an increase of 2.7 percent annually, but still well down on 6.4 percent growth in 2011.

Wang Yong, the commission's chairman, said that central SOEs are being encouraged to withdraw from any business or projects which are not key to their overall strategy.

"Central SOEs are supposed to be attaching great importance to key businesses, accelerating business integration, and divesting any inefficient assets during 2013," Wang said, adding that the commission will be putting stricter controls on the scale and direction of investments in 2013, at home and abroad.

Xu added: "A company's competitiveness usually comes from its core business, and so SOEs should be cautious about making any investment in an unfamiliar business."

In early 2012, the commission asked each SOE to submit an analysis on how to narrow the gap between Chinese central SOEs and top-grade companies worldwide.

During the 12th Five-Year Plan period (2011-15), the major goal of the commission is to develop central SOEs into top-ranking industrial players globally.

There were 42 central SOEs, including China National Petroleum Corporation, the State Grid Corp of China and China Communication Construction Co, named in the Fortune 500 list last year, up from 38 of the previous year.

Xu added that concentrating on its key business is a crucial part of any international company, and that Chinese companies should learn from that principle.

Since 2010, the commission has required all but 16 SOEs - the number of specialist real estate organizations - to quit that sector, for instance.

Last year, 15 SOEs withdrew from 17 real estate projects, according to data from the China Beijing Equity Exchange.

A number of central SOEs have already announced significant moves to diversify their businesses, in ways related to their core activities.

China South Locomotive and Rolling Stock Co Ltd, for instance, China's biggest rail transit equipment manufacturer, said it plans to get into the wind turbine industry by launching a self-developed 2-gigawatt wind power machine on the market.

"Companies developing low-speed wind power machines will benefit from this booming market whose scale will be as much as 20 million kW over the next five years," it said in a statement.

In late January, the mainland's third-largest steel enterprise by output, Wuhan Iron & Steel (Group) Corp, announced a 182 million yuan ($29.21 million) joint-venture with Taiwan-based China Steel Corp to enter the environmental protection industry.

The joint venture will set up a 6.7-hectare production base, producing devices aimed at dealing with chemical pollution in the air.

The Wuhan-based State-run company also reported last year that it has moved into energy, logistics and real estate, which it said would eventually mean that 30 percent of its business revenue would be non-steel.

A surplus is expected to continue in the steel industry this year, according to the National Development and Reform Commission.

"Business diversification should certainly be one of the key strategies for SOEs, but any change in direction must be closely related to their core businesses," said Ye Tan, an economics commentator.

baochang@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

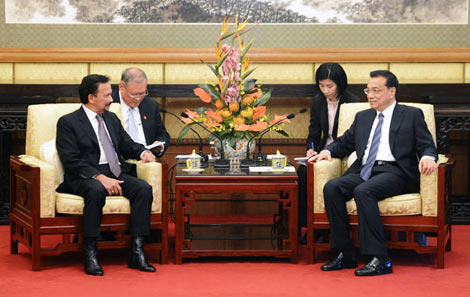

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show