The chances of establishing an offshore yuan center in Africa are high, as trade settlement in the currency continues to surge and sound regional trade on the continent facilitates forming a yuan pool, a senior executive of Standard Chartered Bank said on Tuesday.

Peter Sun, the bank's managing director for transaction banking, Africa, said the main challenge is that all African countries, except for Mauritius, Kenya and Botswana, have currency controls, which restrict the possibility of setting up an offshore renminbi center.

He told China Daily that Mauritius, with a free flow of dollars and trading with other African countries, is becoming a new regional treasury center, as many companies in Africa are moving there from the traditionally favorite centers of London and Dubai.

Sun said government encouragement and language advantage, as Mauritius uses both English and French, will also help the Indian Ocean island, which would be a natural hub for renminbi, based on current conditions there.

"But other countries may also become competitive as their regulations change and evolve in the future," he said.

Chinese central bank statistics show that yuan-denominated settlement between China and some African countries has already started, with 4.3 billion yuan ($684 million) worth of settlement with South Africa and 2.3 billion yuan with Mauritius.

Sun said: "Intra-Africa regional trade is very good. As it becomes more efficient, it will become more natural for Africans to pay Africans in renminbi, because it's all within the same continent. It's not like Singapore paying to London."

The use of renminbi as trade settlement in Africa is still in its infancy, but will develop rapidly, according to Sun.

In 2012, yuan settlement accounted for just 0.5 percent of the total trade transactions between China and Africa, which stood at nearly $200 billion, Sun said. He expects settlement in yuan to rise to $15 billion by 2015.

He said China and African countries also need to develop currency swap agreements, which will help businesses and governments accelerate the use of renminbi as a trade settlement currency.

Li Dongrong, vice-governor of the People's Bank of China, pledged last year to promote use of the yuan in settling trade and investment with Africa, and to encourage African central banks to hold more yuan assets.

Wei Jianguo, former vice-minister of commerce and now secretary-general of the China Center for International Economic Exchanges, said Africa is likely to replace the European Union as China's biggest trade partner in three to five years.

Fan Bing, managing director at Standard Bank, China, said internationalization of the renminbi is inevitable, and Africa - more than anywhere else - is a fertile market offering better opportunities for the currency.

In July, African central banks were given access to yuan-denominated bonds for the first time after China Development Bank Corp allocated them a purchase quota of three-year bonds, viewed as an important development in the yuan's wider use globally.

The central banks of Nigeria and Tanzania made the biggest purchase among their African counterparts, according to a source close to the matter.

wangxiaotian@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

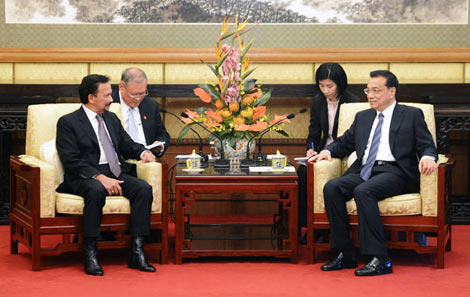

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show