Another option

Instead of directly converting small-sum loan companies into financial institutions, some have proposed establishing more township banks, which are now recognized as "financial institutions" and administrated by the CBRC.

But setting up a township bank is never easy.

In June 2009, the CBRC agreed that qualified small-sum loan companies could be upgraded to township banks.

But the initiator of a township bank had to be a commercial bank, and the commercial bank should hold no less than 20 percent of its shares, meaning private investors could not control a township bank.

"The biggest problem was the initiator stipulation.

"Neither commercial banks nor small-sum loan companies had any interest in investing in a township bank," said Lu.

In May 2012, the CBRC lowered the minimum share of commercial banks from 20 percent to 15 percent. But still, not a single small-sum loan company was transformed into a township bank.

ChenJinbiao, the mayor of Wenzhou, said to push forward China's financial reforms, both local initiatives and central government moves are important.

Wenzhou is the only "comprehensive financial reform pilot zone" approved by the State Council so far.

Its intensively watched reforms over the past year are expected to shed some light on any future reform of the country's private financing and investment regime.

But a year on, even Chen acknowledges there is still a "big gap" between progress and the public's expectation, the current level of service and the demands of SMEs, and regulations remain weak.

A telling fact is that loans made through Wenzhou's private lending registration service center, the official platform supposed to replace the underground banking system, had reached just 423 million yuan by last month.

In comparison, informal private lending in Wenzhou totaled 800 billion yuan, according to Zhou Dewen, the chairman of Wenzhou SME Development Association.

"One of the major reasons is that the previous massive default crisis made private lenders more reluctant to lend, fearing the previous ‘borrow-trapped-run away' scenario would recur," Chen said.

A deficit of trust and credit information about their borrowers might explain the frozen lending. But if the enthusiasm of millions of private investors who have sufficient knowledge of their borrowers, like Dai, is liberalized, the deficit of trust should not be a problem.

"SMEs contribute to more than 50 percent of the country's tax revenue, 60 percent of GDP, and 80 percent of the jobs. They deserve better financial support," Dai said.

zhengyangpeng@chinadaily.com.cn

Related Readings

Lending companies to get boost

Small-loans firm opens in Harbin with focus on Sino-Russian trade

Private lending disputes to increase

Final approval sought for Wenzhou private-financing regulation

Filling the gap in Wenzhou's finance market

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

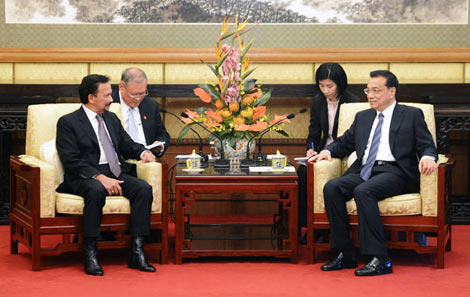

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show