More locals putting their faith in safe havens: industry veteran

Banking is one of the sectors of the African economy in which China is emerging as a significant player.

The Industrial and Commercial Bank of China concluded the largest foreign direct investment deal in South African history six years ago when ICBC paid $5.5 billion for a 20 percent stake in Standard Bank, Africa's largest bank.

Bank of China, which has had a presence on the continent since 1997, and China Construction Bank, which arrived in 2000, are also expanding operations.

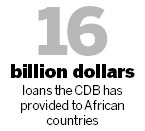

The Chinese government policy banks - The Export-Import Bank of China (China Exim Bank) and China Development Bank - have also bankrolled some of the major infrastructure projects on the continent over the past decade.

The CDB revealed earlier this month it has provided $16 billion loans to African governments and $700 million loans to African small- and medium-sized enterprises.

Liu Yagan, who was one of the architects of the ICBC deal and is now chief representative of ICBC Africa, based in Cape Town, where the bank opened an office of its own in 2011, said the Standard Bank investment has proved a success.

"The first year we worked together, we introduced 700 Chinese corporations operating in Africa to Standard Bank who opened accounts. You can't imagine that would have happened without our investment," he said.

Liu, who was speaking at the Radisson Blu Hotel in Sandton in Johannesburg, said buying a stake was its preferred way of entering Africa.

"We needed to find the best way to enter the continent. Africa is very big with 53 countries, many of them with a different culture. We needed to find a good target with a very strong presence not just in one country, but in many countries," he said.

International management consultant firm Roland Berger said the banking sector in sub-Saharan Africa, in particular, represents a huge growth opportunity.

It estimates that with four out of five adults on the continent having no access to banking services, there are $60 billion a year in deposits up for grabs from low earners alone.

With the banking markets in the United States and Europe being subdued, Africa is now one of the more attractive banking markets in the world.

Chinese banks are now competing head-on against long-established players on the continent such as the UK's Barclays, whose Africa banking operations are now part of the Absa Group, in which it has a controlling interest; the Portuguese BPI bank; Societe Generale of France; the Spanish Banco Espirito Santo; as well as the UK's Standard Chartered and the US' Citigroup.

"You have 50 years of growth you can potentially get out of the African market," said Voyt Krzychylkiewicz, banks analyst at SBG Securities in his office in Exchange Square in Johannesburg's Sandton district.

"It is obviously commodity-rich, which is generally supportive of an economy, and so I think it has significant growth potential."

Societe Generale, which wants to add an additional 100 branches in sub-Saharan Africa to its existing 300, sees expanding in Africa as a way of targeting Chinese companies, many of them involved in the minerals and resources sector.

Bernando Sanchez Incera, the bank's deputy chief executive, said it was now easier to get Chinese customers in Africa than in China itself, where there are tight entry restrictions.

"Our presence in China is limited. In Africa, Chinese companies need a local agent who knows the international rules of the game," he told the Financial Times.

The Chinese banks are seen by some as serving only Chinese businesses in Africa.

But Windsor Chan, a Hong Kong-born veteran of the South African banking scene who is now deputy general manager of China Construction Bank in South Africa, said that a third of his bank's customers now are local.

"We, of course, love to do business with Chinese State-owned enterprises, but it is not our only business. We want to be a regional player and not necessarily just a Chinese player," he said.

Many Africans see Chinese banks as safe havens to put their money, particularly with the perilous state of some European banks, Chan said.

"People see stories of the banking crisis in Europe and wonder where they can put their money more safely. A Chinese bank, of course, because it is backed by the Chinese government," he said.

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show