|

Michael Power is investment strategist at Investec Asset Management, based in Cape Town. [Photo/China Daily] |

|

Windsor Chan is deputy general manager of China Construction Bank in South Africa. [Photo/China Daily] |

Unlike ICBC, CCB does not have a direct stake in an African bank, but has a memorandum of understanding with First Rand Bank with which it works together on some deals.

"It is not an investment-type of thing, " Chan says. "We do not involve ourselves in their management and they don't engage on our side, but we share information and identify where we can do transactions together."

Such is the demand for Chinese banking services, the single branch that Bank of China opened in Zambia in 1997 is now the 8th largest bank in the country.

Qiu was speaking across a huge polished boardroom table in the company's suite of offices on the 14th floor of Alice Lane Towers in Sandton.

"We are the leading bank in Africa for overseas RMB business. In some African countries the value of their currency has not been stable over the past few years and because of the financial crisis, international currencies such as the US dollar, the euro and the Japanese yen have not been stable either. The RMB meanwhile has been appreciating."

Unlike ICBC, Bank of China has not made any acquisitions in Africa but has China desks at a number of Ecobank branches around Africa. It has similar links with other African banks.

"Cooperating with an agency correspondent bank is our main strategy. We have about 11,000 branches in the Chinese mainland and 4,000 overseas with correspondent banks," he says.

Qiu, a former deputy mayor of Yichang city in Hubei province and who was deputy general manager of overseas business development in Beijing before he moved to Johannesburg two years ago, says it is a very cost-effective business model.

"The advantage of doing it this way means we don't have to set up our own base in every country but we can still cover the whole Africa region," he says.

Since buying the 20 percent stake in Standard Bank, ICBC has deepened its relationship with the South African-based bank.

Last year it took an 80 percent stake in Standard Bank Argentina, which its parent wanted to divest to focus on its core African business.

It is also poised to complete the purchase of 60 percent of Standard's UK commodities and foreign exchange businesses for $600 million.

There has been speculation it may also increase its stake in Standard Bank itself, although its international expansion strategy seems still more focused on taking smaller strategic stakes.

"So far we have cooperated well and we don't have any specific plan to increase our stake," says Liu at ICBC.

Some believe attempting to build a presence in Africa through a South African bank is, in fact, a flawed strategy.

"Why do you need to pass through South Africa to get to Ghana or Chad?" says Dr Daouda Cisse, research fellow at the Centre for Chinese Studies at Stellenbosch University in Western Cape and who is from Senegal.

"We don't have Standard Bank in Senegal. We don't have South African supermarket chains. For me it doesn't matter," he says.

Cisse, who specializes in financial services, also believes the impact of Chinese banks on the African banking market is exaggerated.

"What the expansion of the banks is all about is facilitating trade between Africa and China. More and more Chinese are coming to Africa for business and trade purposes and they need banking services. It is no more fundamental than that," he adds.

Krzychylkiewicz of SBG Securities does not think Chinese banks are going to extend beyond corporate banking services any time soon.

"I don't see the desire among the Chinese banks to go in and start a Barclays-type operation in any of these countries. They are effectively focused on corporate banking."

What is clear, however, with Africa's growing middle class the banking market has a lot of potential.

Chan at China Construction Bank is one who still sees significant upside for Chinese banks in the African market, but he says they have to be aware of the risks.

"We see opportunities in the market but the risks we cannot ignore. Doing business here is different from doing it in China," he says.

"The big question is whether Africa is politically stable or not. Over the past five years the political situation is more transparent than before. Nigeria, compared with 20 years ago, has completely changed."

Contact the writers at andrewmoody@chinadaily.com.cn and zhaoyanrong@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

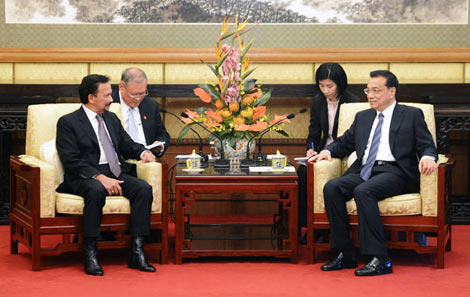

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show