Trading channels 'need to broaden'

While the precipitous fall in global prices has touched off a gold rush among Chinese consumers, gold producers and traders are keen to offload their huge stockpiles to minimize real and potential losses.

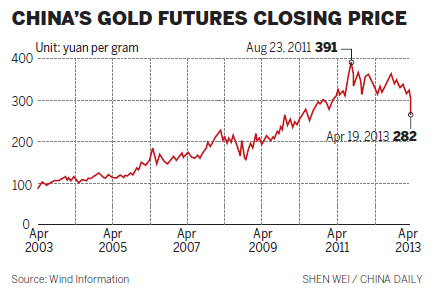

In doing so, they face a common problem that has become increasingly pressing since the price of the metal began to nosedive on April 10. The problem is the restrictive domestic gold futures market that lacks the liquidity and diversity to absorb a sudden surge in sell orders.

When a large number of gold holders want to short the metal to hedge against a further price fall, they have a problem finding enough parties willing to take the bet.

The spot market has a timing issue that imposed a hurdle for investors trying to sell quickly to reduce losses.

As gold trading channels in the domestic market are relatively narrow and the pricing power of China's gold market is weaker than the more mature markets overseas, domestic gold prices are closely linked to movements in international markets with spot gold prices set during the night, Beijing time, when trading is closed, according to Xue Ke, an analyst at Tianjin Jinhengfeng Precious Metals Management Co Ltd.

When the Chinese market opens the next day, the deluge of sell orders can push prices down at a rate that triggers a suspension in trading.

"The gap between trading times in Shanghai, London or New York has been a problem for domestic individual investors in the past few days - as the gold price in the global market dropped off the cliff - we could not sell off because the domestic trading platform was not in trading hours," said Wang Qifen, a Shanghai-based gold futures investor.

Gold producers and jewelry sellers that are listed in the A-share market said large inventory and price risks may affect their performance this year if the gold price continues to fall, but it is too early to tell what measures should be taken at the current stage.

"It is hard to tell how we should adjust our production plan or whether we'll reduce our production goal this year, because the plan for the first two quarters is set already. But if the gold price continues to plunge, we'll take measures against price risks," said a source with Shanghai-listed Henan Zhongjin Gold Co Ltd, a gold producer.

Once economic disappointment sets in, growth commodities and risk assets will likely suffer an even worse blow than precious metals experienced last Friday, said Hong Hao, managing director and chief strategist at the investment banking and securities company BOCOM International Holdings Co Ltd.

Of course, the price drop was seen as a boon by some Chinese customers, who rushed to the nearest jewelry stores to stock up on the metal.

Wei Li, 30-year-old auditor in Shanghai, said he failed to purchase a gold ring as a gift for a friend, because all the gold rings were sold out at a jewelry store in East Nanjing Road in downtown Shanghai.

The Chinese Gold & Silver Exchange Society in Hong Kong said on Friday that it had sold all of its spot gold and has placed orders to Switzerland four times bigger than normal to satisfy mounting demand.

"The surge in gold purchases is spanning markets from India and China to the US, Japan and Europe. Buyers are viewing this as an opportunity to purchase gold at prices not seen in the past couple of years," said Aram Shishmanian, CEO of the World Gold Council.

Cai Xiao in Beijing, Lin Shuying in Shanghai and Gao Changxin in Hong Kong contributed to this story