China reports five consecutive months of net forex purchases

China witnessed a fifth straight month of net foreign exchange purchases among the central bank and commercial lenders, indicating accelerated capital inflows into the country.

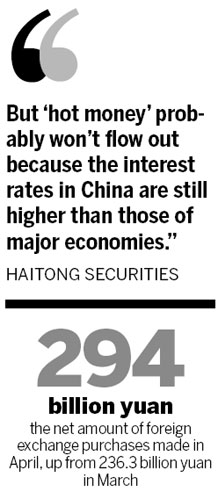

Banks brought in nearly 294.4 billion yuan ($47.9 billion) worth of foreign exchange last month on a net basis, up from 236.3 billion yuan in March, as shown by data released by the People's Bank of China on Wednesday.

The total yuan holdings for such purchases stood at nearly 27.4 trillion yuan by the end of April.

China reported a trade surplus of nearly $18.2 billion in April, compared with a deficit of $880 million in March.

"The April figure reflects continuous capital inflows as major economies ease their monetary stance and the yuan strongly appreciates. The trend is likely to continue with net purchases increasing the in short term," said E Yongjian, senior analyst at the Bank of Communications.

In a report, Haitong Securities Co Ltd said trade surplus contributed 39 percent of the net purchases in April. "Deducting the surplus and foreign direct investment, financial capital inflows including 'hot money' stood at $20 billion, almost the same level compared with March and February," it said.

Haitong Securities also said that in the short term, capital inflows might decline as the trade surplus narrows, direct foreign investment moderates, and the government tightens supervision of foreign exchange.

"But 'hot money' probably won't flow out because the interest rates in China are still higher than those of major economies," it said.

China has witnessed accelerated capital inflows since major economies launched monetary easing policies.

Net foreign exchange purchases have totaled 1.22 trillion yuan in the first three months, in contrast with 500 billion yuan made throughout 2012 by the banks.

The ongoing capital inflows would continue for a while as the difference between financing costs in China and overseas has further widened, said Ding Zhijie, dean of the School of Banking and Finance at the University of International Business and Economics.

Yang Weixiao, a senior analyst at Lianxun Securities Co Ltd, said banks' yuan position for purchasing foreign exchange will probably stay at a high level because the central bank is unlikely to cut interest rates as other economies did while liquidity remains loose.

But Zhu Haibin, chief China economist at JPMorgan Chase & Co, said a possible exit of US quantitative easing would also help soothe the capital influx.

The Wall Street Journal reported on Monday that the US Federal Reserve is getting ready to wind down its $85-billion-a-month bond-buying program in careful steps, but the timing is still uncertain.

Constant money inflows in recent months have posted greater appreciation pressure on China's yuan. The currency has strengthened 1.43 percent against the dollar in the past three months.

On Thursday China's yuan fell for a second day as the People's Bank of China cut yuan's daily fixing to the lowest in nearly two weeks, viewed as a signal that authorities are trying to slow down the pace of appreciation.

It reduced the reference rate by 0.04 percent to 6.2096 per dollar, the lowest since May 6 and 1.03 percent down from Wednesday's spot market closing level, according to data compiled by Bloomberg.

On the spot market, however, the yuan strengthened further and closed at 6.1492 per dollar in Shanghai, according to the China Foreign Exchange Trade System.

"The lower daily fixing might only be a normal callback of the PBOC after the yuan rose too fast in recent weeks. In the second half it might strengthen less rapidly but generally speaking there is no obvious change in appreciation pressure on the currency," E Yongjian said.