|

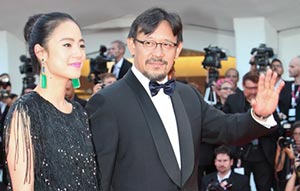

Mike Cavanagh, co-CEO of JPMorgan's Corporate and Investment Bank, which was created in 2012 by merging the bank's Corporate and Investment Bank, Treasury and Securities Services and the Global Corporate Bank businesses. [Photo / China Daily]

|

JPMorgan executive says bank's clients must come first for business to succeed

Constantly focusing on what's truly important at the big end of business and deciding business direction according to clients' needs are central to the core values of Mike Cavanagh, co-chief executive officer of JPMorgan's Corporate and Investment Bank.

The demands of investors have really reshaped what a successful business model in banking looks like following the huge destructive global financial tsunami of 2008, the 47-year-old executive told China Daily.

Cavanagh, former head of JPMorgan's Treasury and Securities Services business, became the first point of contact for decision-making when the company aligned its Corporate and Investment Bank, Treasury and Securities Services and the Global Corporate Bank businesses in July 2012.

The new combined department is called the Corporate and Investment Bank (CIB). The unification is aimed at strengthening its institutional client franchise in the industry and benefiting both corporate and investor clients.

"For both our institutional and consumer businesses, we wanted to do a better job of organizing ourselves around our clients. That was the driving force behind the changes," he said.

"I wouldn't say they were big changes, but I would say it was evolutionary."

According to a public announcement by JPMorgan, the benefits of the Corporate and Investment Bank include a shared balance sheet that can more effectively deliver credit to clients in the form most helpful to them, as well as the benefits of scale that come from combined resources, infrastructure and technology. A globally coordinated coverage team can also better support clients in an increasingly complex regulatory and economic environment with a comprehensive suite of products and services, it added.

The focusing-on-client business model is expected to drive the CIB to concentrate on improving service efficiency, optimizing many capabilities - cash management, custody, prime brokerage, trading, corporate finance and capital - under one roof and being able to deliver tailored solutions in a holistic way.

In 2012, the first year JPMorgan reported the CIB as a combined unit, it achieved a net income of $8.4 billion on $34.3 billion in revenues, up by 26 percent from the full year 2011, the company said.

In the first quarter of this year, it reported $2.6 billion of earnings on $10 billion of revenues, representing an 18 percent return on capital.

"More important than the numbers, however, is what we hear from clients. It's a complicated new world that clients have to navigate," said Cavanagh, who says he is satisfied with the CIB achievements so far.

About 61 percent of the CIB clients are international and 48 percent of its revenue is now generated from international businesses.

The executive saw regulatory changes, including what are known as the Dodd-Frank implementation, Basel capital rule changes and Volcker-Vickers, as "a real challenge" in 2013.

To deal with the effect of Basel III regulations, the CIB increased allocated capital reserves to $56.5 billion since the beginning of this year.

But Cavanagh believes there will be more opportunities for financial groups in underwriting capital markets because client needs for capital are growing. His department set up a target return on equity of 16 percent this year.

Cavanagh has seen financial regulation increase over the past few years of the post-crisis era.

"Much of it is for a very good reason. We support higher levels of capital and stronger, more consistent regulatory rules."

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant