Official data on the United States' exports and imports in May showed further widening of the trade deficit with China, but the figures also signaled shifts in the world's two biggest economies, with implications for global growth.

According to the Commerce Department, the US in May imported $45 billion more in goods and services than it sent abroad. Weak global demand, including from slower-growing China, pushed US exports down.

But the bigger-than-expected monthly jump in the trade deficit was also fueled by higher imports, mostly from China.

Several surveys of economists had predicted a May trade-gap total more or less flat with April's upwardly revised $40.1 billion. Instead, the $45 billion figure was the biggest one-month increase since November, and the $232-billion value of imports was the second highest in US history, just $2 billion off the mark set in March 2012.

US exports in May stood at $187.1 billion, the Commerce Department said in a report that also revealed a stark difference in month-to-month trends: exports down by a seasonally adjusted 0.3 percent and imports up 1.9 percent.

The US trade imbalance with China expanded to $27.9 billion from $24.1 billion in April. The more recent month saw a $200 million decrease, to $8.8 billion, in exports to China (mainly civilian aircraft, engines, equipment and parts) and an increase in imports of $3.5 billion, or 10.7 percent, to $36.6 billion (mainly mobile phones and other household items). These figures were not seasonally adjusted.

Strong demand for exports has kept the US growing, though at a modest 2 percent, in recent years. Without it, many economists fear the economy could fail to break out of this extended post-crisis pattern, or even fall into a 1.5-percent or lower range.

Last week, the Commerce Department revised its estimate of first-quarter GDP growth to an annualized rate of 1.8 percent from an initial projection of 2.4 percent, largely due to reduced consumer spending.

"China-US trade is of high complementarity and China has run a trade surplus for a long time," said Li Guanghui, deputy head of the Chinese Academy of International Trade and Economic Cooperation, which is affiliated with the Ministry of Commerce.

"The fundamental reason for the trade imbalance lies in US restraints on exports of high-tech products as well as dual-purpose goods and related technology, which would effectively balance bilateral trade."

He added that China retains great demand for US exports despite slowing economic expansion, while the US' slow economic recovery cannot be reckoned as solid before the end of this year.

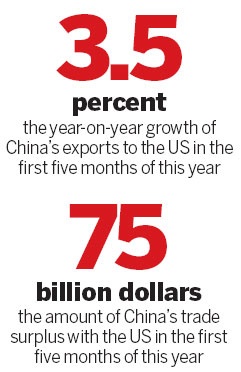

In the first five months of this year, China's exports to the US rose 3.5 percent year-on-year to $138.97 billion while China's imports from the US surged 15.1 percent to $63.94 billion, yielding a trade surplus of $75.03 billion, according to China's General Administration of Customs.

Meanwhile, investors and major US government creditors such as China are trying to guess when and if the Federal Reserve Board will decide to begin tapering its program of bond-buying (quantitative easing), presumably based on a determination that the recovery could sustain itself without the central bank's stimulus, which is now on a pace of about $45 billion a month.

After Wednesday's early closing on US markets before the Independence Day holiday, eyes will be on the Labor Department's monthly jobs report on Friday, since unemployment (now at 7.6 percent) is a key driver of the Fed's monetary policy.

Nicholas Lardy, an expert on the Chinese economy at the Peterson Institute, said the latest US-China trade figures are likely to "heighten the desire on the US side to pin China down as much as possible on the domestic reform agenda and how it will promote rebalancing" when officials from the two countries meet next week in Washington.

The fifth Strategic and Economic Dialogue runs from Monday through Friday and is sure to include further US pressure for China to further liberalize its economy.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant