The change in the administrative structure at the People's Bank of China, the central bank, could have played a particularly important role in the change in monetary policy stance. As Governor Zhou Xiaochuan moved up the political hierarchy and became by far the most experienced monetary policymaker in China, the PBOC has in effect, although not necessarily institutionally, gained more autonomy in the setting of monetary policy. Given that the new senior leadership is less dovish and social criticism of "excess liquidity" is, rightly or wrongly, widespread, the PBOC may have found it easier to implement a hawkish bias.

While the individual preferences of most senior policymakers matter significantly for the above overly simplified description of policy making styles, the latter also reflects a change in social preferences.

When the economy was running well in terms of wealth and job creation during the early 2000s, it was more difficult to push for aggressive fundamental reforms, as many in society and government probably believed that "if it isn't broken, don't fix it".

While we believe the system is far from broken, social preferences are likely to have changed as a result of sustained economic development, with its heavy toll on the environment and increased wealth for a significant portion of the population. For example, wealthier citizens and policymakers may now value clean air more highly than financial wealth.

On the other hand, as the economy has expanded continuously (it was still expanding even at the trough of the cycle), the absolute level of pollution by various measures has also increased continuously. The high levels of air pollution in many Chinese cities since last year may have marked a turning point in the social attitude toward pollution controls, and the policy comments and changes since then are to a large extent a result of this. Such a change in social preferences is another reason why the PBOC's hawkish bias may last longer than would otherwise be the case.

But it is not all bad news.The flipside of this seemingly bad news for the near-term growth outlook is that we may see a reduction in systemic risks, especially in the financial system, provided there is no persistent over-tightening.

The latter could result in a debt deflation scenario that would lead to even more risks. We think policymakers understand these risks in principle, although exactly how much tightening is too much is never an easy question to answer. However, if the recent level of interbank liquidity tightness is maintained, we would probably see a normalization to a tighter level than earlier in the year but not quite as tight as now.

Furthermore, more reforms can raise the level of potential growth. Whether this would be sufficient to offset the demographic headwind is much less clear and will depend on the decisions taken at the forthcoming Third Plenary Session of the 18th Party Congress.

As a baseline scenario, we may continue to see a gradual fall in potential growth, but a long way off the collapse foreseen by many bears. Our relatively cautious stance is partially based on the observation that there has been a clear willingness to implement some important reforms, such as reducing the administrative burden on the economy.

The author is an economist with Goldman Sachs / Gaohua China.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

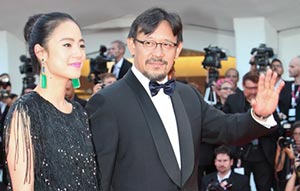

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant