A first-half home-buying spree in China lifted the top 10 developers' sales by 44 percent year-on-year to 490 billion yuan ($79.8 billion) and expanded their market share, confounding bearish expectations, a report by the China Index Academy said.

The academy is a research institute attached to the country's largest real estate website, SouFun Holding Ltd.

According to SouFun, China Vanke Co Ltd took the lead. Public information shows Vanke sold 7.16 million sq m of properties, up 18.9 percent. These robust sales propelled its revenue to 83.67 billion yuan, up 33.79 percent.

The Shenzhen-based property giant reported only single-digit year-on-year growth in the first half of 2012.

Another report, this one from the China Real Estate Information Corp, ranked Guangzhou-based Evergrande Real Estate Group first in sales performance by area, with sales of 7.29 million sq m, up 26 percent year-on-year. Revenue totaled 48.2 billion yuan, up 38 percent.

Rising sales revenue and space also facilitated the consolidation of major developers. The top 10 developers' first-half market share increased 0.75 percentage point year-on-year to 9.85 percent, in terms of sold property area, the CRIC report said.

In the first five months, 391 million sq m of residential space was sold across the nation, representing a year-on-year surge of 35.6 percent, said Ding Zuyu, executive president of E-House (China) Holdings Ltd, who forecast full-year sales to top 1.2 billion sq m.

"Since 2010, China's residential property sales have steadied at 1 billion square meters per annum," said Ding, who noted that the property market posted the best half-year performance this year.

The central government's latest efforts to cool the property market, which include a 20 percent tax on the gains of pre-owned homes, seems not have achieved the desired effect. Instead, potential homebuyers decided to stop waiting and sign purchase contracts, for fears that prices would only shoot up further.

"Massive transactions in March, which were made to evade new, pending tightening policies, gave a boost to developers' sales. But other factors contributed to the impressive sales, including developers' good strategies and an improved financing According to Chen, real estate companies used "unconventional sales strategies" to maintain their sales speed even during low seasons, which greatly helped sales and eased their capital flow.

As for the second half, analysts said there is little chance of additional tightening policies affecting the property market.

"The new leaders tend to use long-term measures rather than short-term administrative policies to rebalance the property market. According to my projection, further reining in the market is [the] least possible," said Ding.

Lin Bo, deputy general manager with the CRIC research center, said the real estate market started to pick up last year, and without the unusual conditions in March, the overall market trend would have been upward.

But as the economy slows and the central bank squeezes commercial banks' liquidity, Lin said, the second half will be more difficult, especially for smaller developers.

"The overall environment will gradually eliminate small firms with only a few projects nationwide, not only because they are less competitive in financing, but also they are at a disadvantage in bidding for high-quality sites," said Lin.

Ning Jingbian, an analyst with China International Capital Corp, agreed.

"The next three to five years will be a crucial period for the market players, and those fittest for the market will survive. More real estate monopolies will dominate the property market," Ning said.

According to Ning, similar developments occurred in Hong Kong in the 1980s and 1990s, and the top 10 developers accounted for more than 60 percent of Hong Kong's property market after the consolidation.

Despite the discouraging economic climate, Chen said major developers will have a good second half. "They are less dependent on 'shadow banks' than small developers are, and the decreasing property inventory means both home prices and demand will be on the rise," added Chen.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

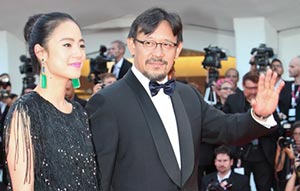

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant