While the likely effectiveness of these measures is less clear at the moment and some, especially the abolition of the floor for lending rates, are likely to have minimal near-term effects, the intention of providing more financial support for the real economy is clear.

As a result, these measures do not suggest wholesale "deleveraging" but rather a controlled pace of continued "leveraging". Although in the second quarter of 2013, nominal GDP growth was only 8 percent, all measures of aggregate liquidity growth still well exceed this level (loan and M2 growth both just slightly above 14 percent year-on-year in June). Even though June liquidity conditions were extremely tight, total social financing growth was still 20.2 percent year-on-year.

With further measures to support growth including fiscal measures, we believe the overall level of leveraging as measured by the liquidity supply/nominal GDP ratio will still go up - although at a slower pace than in recent years.

We believe this combination of maintaining macro stability while furthering structural reform is sensible. The two goals are not mutually exclusive although they will sometimes be at odds (as in the case of environmental protection which often puts pressure on activity growth).

Indeed, without further reforms to the fundamental economic structure, slower growth amid very tight liquidity conditions as in June could worsen the economic structure because private sector businesses, many of which are innovative small and medium-sized enterprises, tend to suffer more in this environment.

Furthermore, although there are many who believe that growth is currently less of a concern because employment conditions appear to be relatively stable, the non-performing loan ratio remains low, and consumer price index inflation is largely steady in the 2 to 3 percent range, these are at least partially the result of considerable efforts by government institutions.

In a fully liberalized financial system and labor market, employment conditions and NPLs would likely be somewhat worse by now. Because this level of support given by the government cannot be sustained indefinitely, we believe the premier is quite right in emphasizing growth stability during the reform process.

To say the new administration pays significant attention to growth does not mean that its focus on growth is unchanged. Indeed, the tolerance for slower growth is likely to be greater than in the past decade and there is a greater emphasis on other goals such as reform, environmental and risk management issues.

But the administration is clearly not likely to tolerate slow growth as much as in the late 1990s when the Chinese economy experienced deflation for as long as five years while undergoing monumental structural reforms, including restructuring of the government, State-owned enterprises and the entry into the World Trade Organization. So, while growth concerns related to Likonomics have some truth to them, we consider them to be overblown. Rather, we expect the new administration to take a moderate approach to cyclical management and structural reform.

As a result, we will see some growth and some reform but neither will likely be extremely aggressive. More specifically, we believe the current cyclical management plan will be mostly dependent on fiscal instead of monetary measures to support demand growth in areas mentioned above (in terms of urban redevelopment etc). This can be done via spending some of the funds allocated (therefore counted as fiscal expenditure) but not spent by the fiscal funding receiver, especially in light of the saved funds from the anti-corruption campaign.

By the end of June, there were 3.4 trillion yuan ($554.3 billion) of fiscal deposits (this is what the government deposited at the central bank) and 14.7 trillion yuan of other deposits made by government agencies and other State-funded public organizations (these are deposited at commercial banks).

While certainly not all of this money can be spent, some of it can be. This means a relatively large amount of actual spending can occur without affecting the official budget deficit number, although it is not clear how much exactly can and will be spent. Additional support could come from faster fiscal expenditure within the year.

A large chunk of fiscal expenditure is scheduled to take place in the last month of the year, which will affect the economy early in the following year more than in the current year. Bringing it forward can therefore give more support to the current year's growth without changing the annual budget. A third option would be more broadly defined public-sector spending including by State-financed or controlled organizations and SOEs. Encouraging them to spend more will not affect the fiscal budget, yet may have some positive impact on near-term growth.

In terms of fundamental reforms, there has been much hope for the third plenary session of the 18th Party Congress. While we believe we are most likely to see more on fiscal and financial reforms, other fundamental changes such as the land system (which is very closely linked to urbanization and the property sector development) and SOE reform are much less clear.

The author is an economist with Goldman Sachs / Gaohua China.

The views do not necessarily reflect those of China Daily.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

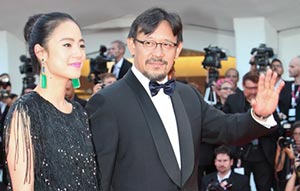

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant