"In the future, the cooperation in many key areas would be further strengthened, including retailing, cards, infrastructure financing and Chinese currency business," Li added.

In terms of renminbi business in Africa, many countries have bought their national debts in the currency, including Tanzania and Nigeria, and BOC has become the leading bank in Africa in promoting this service.

"Due to BOC's global networks and exceptional global settling capability, it plays a key role in the international settlement of RMB worldwide," he said. "It has been chosen as the official bank for RMB settlement in the Philippines, Russia, Malaysia, Luxemburg and other regions of the world." BOC will now be the sole settlement bank for RMB-related financial services of the Nedbank Group in Africa.

As one of the earliest explorers of the African market, BOC's scope covers many sectors, with clients in the mineral industry, media, finance, import and export, manufacturing, real estate, infrastructure and energy industries.

"This is because we now have a full-range of services that are needed by Chinese companies in Africa," Li said.

Apart from increasing the number of branches and representative offices in African countries, the BOC also has established many partnerships to expand its business and global influence.

As the ninth largest bank in the world and China's most international and diversified bank, BOC provides a comprehensive range of financial services to customers across the Chinese mainland, Hong Kong, Macau, Taiwan and 37 overseas countries.

In 2011 and 2012, BOC was classed a Global Systemically Important Financial Institution, as determined by the international Financial Stability Board. BOC is the only financial institution from China or any emerging economy to be recognized as a SIFI, a bank whose failure might trigger a financial crisis.

BOC established its Johannesburg branch in 2000, which has supported and witnessed the rapid development of economic and trade exchanges between China and African countries.

Yang Baorong, a researcher in West Asian and African studies at the Chinese Academy of Social Sciences, who is also an expert of China Development Bank, said the BOC-Nedbank agreement is part of move toward creating closer financial ties between China and Africa.

On Aug 23, China's official bankcard transaction processor UnionPay International and its South African counterpart BankservAfrica signed a memorandum of understanding in Johannesburg to facilitate cooperation on bankcard acceptance and issuance and other payment services, and to explore further development in the African market.

In 2007, China's biggest commercial bank, Industrial and Commercial Bank of China, purchased 20 percent of South Africa's Standard Bank Group for $5.5 billion, to become the biggest shareholder of the Johannesburg-based lender.

Last year, Standard Bank sold 80 percent of its Argentina business to ICBC. Last month, Standard Bank was also reported by Reuters to be in talks about selling its London commodity trading business to ICBC. "The purchase of Standard Bank by ICBC was viewed as a successful case, which can also provide an example for BOC," Yang said.

Expanded currency exchange between BOC and Nedbank will lead to a greater storage of RMB in the South African market, which is in line with the Chinese government's determination to widen global use of RMB and internationalization of the currency, he said.

Yang said African countries have been trying to reduce their use of dollars since the US adopted quantitative easing, which harmed exports of resources and energy. A larger RMB reserve would serve as a tool to withstand external risks.

In southern African countries, where there is a relatively stable political environment, an increasing number of small and medium-sized enterprises have entered the market, generating demand for credit support, Yang added.

However, he warns about the risks connected to infrastructure projects, such as hydropower and transportation, as they often involve border issues between countries after construction begins, and so affect the banks providing credit support.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

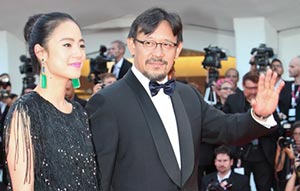

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant