"In the West, government intervention is exercised in the form of regulation. But in Qatar, Brazil and many other emerging markets, the state is an owner of many assets, and as an owner it has to participate in decision-making processes," Cossin said.

He said such a structure builds on the concept of responsible shareholding. According to Cossin, this concept is demonstrated in the West by a recent law in Switzerland, which requires all institutional shareholders to vote in general assembly meetings.

Cossin said a second group of organizations that can draw lessons from Chinese banks' corporate governance is sovereign wealth funds, in both developed and emerging markets, because, again, the state is a major shareholder.

A third group that can draw similar lessons is Western banks, although here the lesson is not one of structure but of part-time non-executive directors' dedication to their roles, he said.

"Western boards are evolving," said Cossin. "In the past, the culture of the West was a culture of leadership, meaning that the CEO was most important, and the board of directors was secondary. We are now moving from a culture of leadership to a culture of governance."

Cossin said traditionally non-executive directors on the boards of Western banks tend to be influential figures, but may not have enough time to commit to the companies they advise.

He said one example is the Swiss bank UBS, which a few years ago had on its board of directors people such as Peter Voser, CEO of Shell, and Sergio Marchionne, CEO of Fiat.

"These people's No 1 dedication is to their own company. They are dedicated to UBS, but it's not the same type of dedication as the non-executive directors of Chinese banks," Cossin said.

However, increasing scrutiny of the work of boards of directors in the Western media in recent years is putting more pressure on those banks' non-executive directors, Cossin said.

"Social pressure on directors is increasing. If you look at financial publications around the world, what the boards do is key. Only five or six years ago, most people didn't know who were on the boards of large corporations, and they were not talking about board members.

"In the past, the CEO was considered responsible if something went wrong, and now the board is."

Cossin said that compared to Western non-executive directors, ICBC's part-time non-executive directors demonstrate much more personal dedication to their roles.

"They are very committed, they are very engaged, they have a true heartfelt intention to make the bank successful," Cossin said. "I'd call it personal dedication. They feel they are contributing to something greater than themselves."

As an expert on the banking industry, Cossin has advised many banks around the world, including the European Central Bank, HSBC, Bank of America and Goldman Sachs. In China, Cossin has also advised the Agricultural Bank of China and the Bank of Communications.

Such experience enabled him to observe Chinese banks' rapid transformations, which mainly started in the early 2000s, when China's admission to the World Trade Organization promised a gradual removal of barriers for foreign banks, and added urgency to China's traditionally government-controlled and protected banks to become increasingly market driven.

As Cossin observes, China's biggest banks have since improved their operation efficiency through measures such as debt restructuring and improving capital adequacy, implemented robust corporate governance systems to ensure checks and balances, and sought listings on stock exchanges to encourage more market discipline.

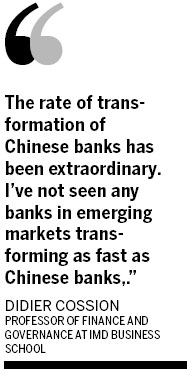

"The rate of transformation of Chinese banks has been extraordinary. I've not seen any banks in emerging markets transforming as fast as Chinese banks," Cossin said.

To put this transformation in context, in 1999 ICBC was considered by international institutions and analysts broadly as "technically bankrupt" with a non-performing loan rate reaching 47.59 percent, said Cossin, adding that such pressure could have been one motivation for transformation.

Cossin believes Chinese banks today have the ambition to become truly global institutions, and to be on par with leading banks internationally, although challenges still exist. He hopes these challenges will turn into pressure to urge Chinese banks to pursue further change.

"Chinese banks can still improve their IT systems, in terms of credit approval, information management, risk control and risk supervision," he said.

"At the same time, there is pressure in China from the government in the form of changing policies for liquidity provision and capital ratios, so these pressures force banks to rethink and fine-tune their systems. Hopefully these pressures will create a good chance for further transformations."

Alexander Bloom contributed to this story.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant