For the past several months, Asia's richest man Li Ka-shing has been selling most of his real estate and businesses in China and buying British companies related to public facilities.

If not so long ago Chinese investments in Africa and South America were regarded as more compelling, for the past two years it seems China's participation in acquisitions in Europe has been attracting greater attention.

Statistics confirm there has been a sudden increase in Chinese acquisitions in Europe.

In 2011, China's acquisition investment in Europe totaled $10.4 billion (7.7 billion euros), accounting for 34 percent of its total overseas acquisitions that year, compared with 10 percent in 2010. While the percentage of acquisition investment in North and South America decreased from 34 percent to 27 percent. Europe became China's largest acquisition investment destination.

In 2012, Chinese acquisitions in Europe grew by 20 percent and the amount spent was for the first time bigger than that of European acquisitions in China. Again, Europe was the region with the largest acquisition activity for China.

Chinese enterprises are attracted to the European acquisition market mainly for two reasons.

The first is that European enterprises are walking out of the shadow of the sovereign debt crisis, but the prices of their equities are still low, which makes the stock market attractive for foreign investments.

Although the American stock market has rebounded significantly after the financial crisis of 2008, the European stock market has been under-performing. It is still facing substantial risks, but recovery is becoming increasingly evident.

Studies have also shown that the earnings of European corporates are mostly 0.5 to 1.5 percentage points better than the global average. Some investors think European assets are 30 percent cheaper than similar American ones.

In fact, not only has China increased investment in Europe, so have the US and other developed countries. In the first half of this year, US pension funds and large consortiums invested nearly $65 billion in the European stock markets. The European stock markets reached a three-month high mainly because of the increasing number of acquisitions.

The second reason is that European acquisitions are particularly important for Chinese enterprises to enable them to transform and upgrade.

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing

Asia Bike Trade Show kicks off in Nanjing

Asia Bike Trade Show kicks off in Nanjing

Student makes race car for 4th Formula SAE of China

Student makes race car for 4th Formula SAE of China

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

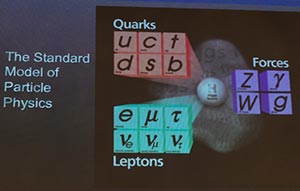

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus