|

[Photo / China Daily] |

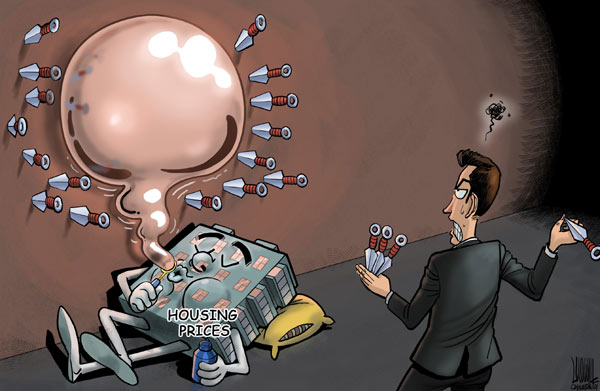

Urban housing prices climbed further last month, with the cost of buying a newly built residence surging by more than 20 percent in four major cities, the National Bureau of Statistics said on Wednesday.

Of the 70 major cities monitored by the NBS, there was only one - Wenzhou, Zhejiang province - where prices declined year-on-year.

Shanghai, with an increase of 21.9 percent, led the list. Beijing ranked second, with a 21.1 percent gain, followed by Shenzhen (21 percent) and Guangzhou (20.9 percent).

On a month-on-month basis, prices rose in 66 cities, with the largest gain coming in at 1.3 percent. Prices were flat in three cities. Overall, 94.3 percent of the cities posted monthly price increases in November.

The situation in the pre-owned property market was very similar.

"House price inflation has largely been driven by a rebound in residential demand, fueled by urbanization and strong growth in disposable income.

"Demand has been artificially suppressed by property tightening policies in recent years, but the impact has been diminishing," said Zhu Haibin, JPMorgan China chief economist.

The general easing in credit conditions since the second half of 2012, and the absence of additional national property tightening measures, also supported housing prices, Zhu said.

According to Nie Meisheng, former head of the China Real Estate Chamber of Commerce, China's housing prices are approaching a peak, similar to what happened in the United States in 2005.

"It doesn't make sense that home prices will continue to go up while overall economic growth is slowing down," Nie said earlier this month.

Investment bank UBS AG forecast a 5 to 7 percent year-on-year home price increase in 2014.

"Home price growth will slow in 2014, depending on liquidity in the market," said Gao Ting, UBS Securities' chief China strategist.

"Prices in the country's key cities, such as Beijing, Shanghai, Guangzhou and Shenzhen, are set to rise further in the next year, because of robust demand and comparatively low supply. But some second- and third-tier cities may see flat or even sliding prices."

Frank Chen, executive director of real estate consultancy CBRE Research China, held a similar view. Home prices in first-tier cities will remain bullish in the coming three to five years due to robust demand, he said.

"Given the demographic figures in Beijing, for instance, there are still oblivious shortages of supply in the next few years, thus underpinning high property prices," said Chen.

Property sales are expected to rise 8 to 10 percent year-on-year in 2014, according to UBS. Sales growth, according to the UBS report, is being driven by the country's urbanization push.

Policy changes in a few second- and third-tier cities recently demonstrated that the government was looking at a "bottom-up" approach.

Hence, future policy direction will become more market-oriented and specialized, depending on price trends and economic conditions in local cities, according to Gao.