China's yuan is expected to continue to appreciate in 2014, but at a slower pace, economists forecast.

Deutsche Bank forecasts the yuan will appreciate against the US dollar by roughly 2 to 3 percent in 2014, and that renminbi cross-border trade settlement will increase by roughly 50 percent to 6 trillion yuan ($991 billion), or approximately 20 percent of China's global trade volume.

"Looking to 2014, we expect the yuan to continue to appreciate moderately, with the yuan-to-US dollar bilateral rate expected to rise to the level of 6.0," said Zhu Haibin, China economist at JP Morgan.

The expected global economic recovery should support China's export sector, which should stabilize China's current account surplus at about 2 percent of GDP.

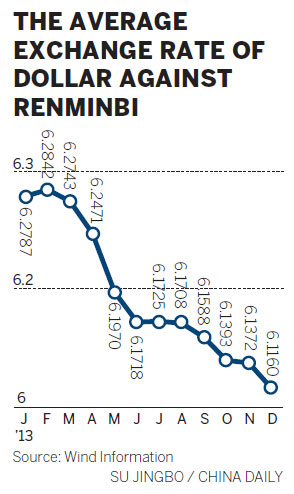

The yuan exchange rate was close to the equilibrium level in 2013.

On Tuesday, the Chinese currency weakened 31 basis points to 6.1053 against the US dollar, according to the China Foreign Exchange Trading System.

In China's foreign exchange spot market, the yuan is allowed to rise or fall by 1 percent from the central parity rate each trading day. The central parity rate of the yuan against the US dollar is based on a weighted average of prices before the opening of the market each business day.

Nominal trade-weighted yuan has appreciated by 6.1 percent since the beginning of the year, amid the notable weakening of the Japanese yen and volatility in the currencies of major emerging markets through the course of the year.

"On the policy front, as part of the financial reform package, we look for the widening of the daily trading band for dollar/yuan from 1 percent to 2 percent in the near term, which should increase the two-way volatility in the currency," Zhu said.

As renminbi business globally continues to expand, Deutsche Bank expects foreign exchange market turnover to get a further boost in the year ahead.

The bank forecasts that after almost doubling in 2013, renminbi FX daily trading volume will rise to $4-4.5 billion in spot and $7-7.5 billion in forwards in 2014.

The total offshore deposit base is expected to reach 2.25 trillion yuan by the end of 2014.

Net issuance of offshore renminbi bonds or certificates of deposit is expected to reach 300 billion yuan, with new supply roughly evenly split between bonds and CDs.

"The growth spurt in the renminbi market in 2013, driven by policymakers' intensified efforts to relax the capital account and expand use of the currency in other regional centers will position the yuan well for continued development in 2014," said Deutsche Bank Greater China Rates Strategist Liu Linan.

Next year is expected to be characterized by a transition to a new market development stage underpinned by significant market expansion, rapid product innovation, increased market liquidity and more efficient pricing discovery for all offshore renminbi products.

For Michael Andrew, chairman of KPMG International, further opening up of China's capital markets will be important not just for China, but for Chinese businesses and the global economy.

"If we are to effectively foster growth we need to get this capital flowing. There has not been nearly enough activity in the financial markets this year," Andrew said.

He firmly believes the capital is there and said if it starts to become more active, particularly across borders, that will aid growth.

"Increased liquidity will drive growth. We just need to ensure that governments and regulators facilitate rather than inhibit this," Andrew said. But he admitted there is a risk that capital will be drawn to the developed economies of the United States, Western Europe and Japan, where recovery is setting in. This may leave emerging markets exposed and short of the capital needed to further their development.

There has been some notable volatility in capital and financial accounts in the past two years.

In particular, in 2012, capital and financial accounts registered a deficit of $16.8 billion (excluding a deficit of $79.8 billion in the errors and omissions account), which was the first deficit in the capital and financial accounts since 1998.

This reflected the preferences of the domestic private sector, especially the corporate sector, to adjust their currency mixture of assets through the course of 2012, as yuan appreciation was no longer seen as a one-way bet amid domestic and global economic uncertainty, according to JP Morgan.

As such, the overall balance of payment surplus narrowed to 96.55 billion yuan in 2012, the lowest balance of payment surplus since 2002.

In 2013, as the Chinese economy stabilized, capital inflows resumed, with the capital and financial accounts (including net errors and omissions) registering a surplus of $57.3 billion in the third quarter and a total surplus of $162.4 billion in the first three quarters.

Net foreign direct investment inflow, which tends to be medium to long-term in nature, came in at $118.3 billion during the first three quarters of the year, which was moderately lower than the $128.5 billion seen during the same period a year earlier.