Investors turned to the US dollar on Thursday after Federal Reserve Chairwoman Janet Yellen hinted at an interest rate rise next year.

The Fed announced that it is scaling back the monthly bond-buying program, known as quantitative easing, by another $10 billion, to $55 billion. It is widely expected that it will announce an end to the program in October.

Yellen said at a news conference that she sees a period of "around six months or that type of thing” between the end of quantitative easing and the first rate increase, meaning an interest rise could come as early as March next year.

A rate rise could attract funds back to dollar assets and weaken emerging-market currencies, including the yuan.

Bank of America Merrill Lynch pared its year-end forecast for the yuan against the dollar to 6.05 from 6.02, meaning that the yuan will see its first year-on-year decline since 2009.

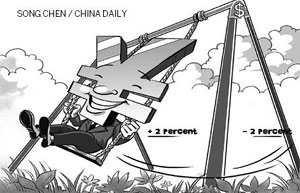

It also expects the central bank to widen the yuan's daily trading band to 4 percent in the second half of this year from 2 percent.

Standard Chartered has revised its end-of-June forecast for the yuan to 6.06 from 6.01, while maintaining its year-end target of 5.92, while Barclays has also reduced its year-end forecast, to 6.05 from 5.95.

On Wednesday, the central bank said Chinese banks' net foreign exchange purchases totaled 128.25 billion yuan ($20.71 billion) in February, indicating that traders and investors have become less willing to hold yuan.

Net foreign exchange purchases by banks are a major source of liquidity in China, and a slowdown in such growth would mean that already tight money policy is becoming tighter.

Zhang Zhiwei, an analyst in Hong Kong with Nomura Securities, said in a research note on Thursday that he had seen increasing concern over growth among Chinese lenders, and forecast a possible round of policy easing in the second quarter.

Chen Fengying, head of the World Economy Research Institute at the Contemporary International Relations Research Institute, said a weaker yuan will benefit exports and help industries including steel, textiles and automobiles.

But Chinese airlines' balance sheets have been hit by the yuan's depreciation, as they usually buy planes through leased financing and pay in dollars, but their income is denominated in yuan, experts said.

Li Xiaojin, a professor at China Aviation University in Tianjin, said that generally speaking the entire aviation industry will lose 700 million yuan if the currency depreciates by 1 percent.

Contact the writers at gaochangxin@chinadaily.com.cn and wangwen@chinadaily.com.cn

|

|

| Widen the trading band of the yuan | Yuan exchange rate's floating range widened |