China's top securities regulator is encouraging candidates for initial public offerings to shift to the over-the-counter market to avoid a prolonged wait.

In a news briefing in Beijing on Wednesday, the China Securities Regulatory Commission also said for the first time that it will allow candidates to choose freely between Shanghai and Shenzhen stock exchanges, a policy relaxation that is in line with its reform toward a registration-based system that prevails in developed markets.

|

|

|

China's over-the-counter equity market received a major boost this year after Beijing set up a nationwide marketplace. In January, a total of 266 companies listed on the market with a value totaling 37.7 billion yuan. As opposed to its regional counterparts, the national market allows companies with more than 200 stockholders to list.

"It's a signal that the CSRC wanted to give the OTC market a boost," said Zhang Qi, a stock analyst with Haitong Securities Co Ltd.

Analysts believe giving companies freedom of choice over the location for an IPO will benefit the Shanghai Stock Exchange, which has been trailing the Shenzhen Stock Exchange in the number of its listings.

In China, the Shenzhen Stock Exchange typically plays host to companies that offer fewer than 50 million shares in an IPO, whereas Shanghai houses those that issue more than 80 million shares. Those issuing between 50 million and 80 million shares can list in either Shanghai or Shenzhen.

In the statement, the commission said the choice of location will become irrelevant to the size of the IPO and companies that have already handed in applications can update their listing venue.

Small IPOs dominated the market after the launch of the SME Board for small and medium-sized enterprises on the Shenzhen bourse in 2005, putting Shanghai at a disadvantage.

"The commission will conduct IPO examinations and approval work based on the principle of balancing the Shenzhen and Shanghai stock exchanges," said Zhang Xiaojun, a commission spokesman.

Open records show that eight out of 10 IPOs have been small since 2008. The scales tilted further away from Shanghai after 2009, when Shenzhen rolled out its ChiNext board for startups.

The CSRC will also continue to improve regulations regarding QFII and RQFII investment and create favorable conditions for overseas long-term capital to enter the domestic capital markets, said the spokesman.

|

|

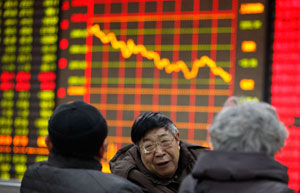

| China's CSI300 index in biggest loss in 7 months |