|

|

Workers look at a ladle pouring molten iron into a container at a steel plant in Hangzhou, Zhejiang province in May 30, 2012 file photo. [Photo/Agencies] |

SHANGHAI - A network of loan guarantees set up to improve companies' access to credit in one of China's richest districts is creating new risks of default as some debts sour, another sign of how private firms are bearing the brunt of an economic slowdown.

Chinese media have reported on a credit crunch developing among steel and textile manufacturers in Hangzhou city, 175 km (110 miles) south of Shanghai in Zhejiang province, as the failure of some to repay loans pushes their burden onto healthier firms.

Hangzhou is part of the Yangtze River Delta (YRD), an engine of growth during China's boom years but now the source of a third of non-performing loans in the country.

|

|

|

"The textile industry is not a big borrower in the banking sector. The problems that we see arise when mutual guarantees go bad and textile firms are dragged in," said Robert Yang, assistant to the president at the China National Textile & Apparel Council.

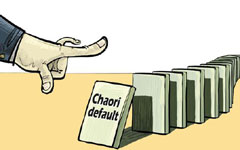

Concern about the huge growth in Chinese corporate debt since the global financial crisis has intensified this year as the government allows market forces to play a bigger role in deciding winners and losers.

Private firms often struggle to obtain credit from State-owned banks, which prefer to lend to State-owned firms due to their government backing.

That trend has worsened as economic growth slows, credit conditions tighten, and authorities work to reduce excessive investment and overcapacity in some sectors.

Steel and textile manufacturers in Xiaoshan, like other private firms around the YRD, sought to overcome such obstacles by providing loan guarantees for each other to gain bank credit.

Now defaults by a few companies threaten a chain reaction that could ensnare even profitable firms, as the guarantees have left them on the hook for debts of their bankrupt competitors.