Various signs indicate that instead of loosening credit, China has targeted "lower financing costs" as a priority for the second half of this year.

On Aug 14, the State Council (cabinet) issued a 10-point document that outlines plans to cut corporate financing costs. The document follows a call by Premier Li Keqiang in July to reduce enterprises' funding costs.

China's borrowing costs are among the world's highest, and they have risen rapidly in the past year. In 2013, the average one-year loan rate was 6.15 percent. In Germany, it was 3 percent and in the United States, just 2.25 percent. And this year, the rate has surged 60 percent, according to Zheng Xinli, executive vice-president of the China Center for International Economic Exchange, a government think tank.

Small companies can only dream of borrowing at 6.15 percent. They must pay 15 to 25 percent - if they can get a loan at all.

The predicament vexing policymakers and economists is that China's financial system is not short of cash. On the contrary, it is awash with money. So how is it that in a country with 120 trillion yuan ($19.5 trillion) in M2 money supply, borrowing costs are so high?

The State Council document itself gave quite a good explanation. It said that the problem could be attributed to "macro and micro issues" as well as "issues in the real economy and financial system" and "long-term and short-term factors".

Its 10-point prescription revealed in another way what are the specific problems pushing up the cost of credit. For example, the government is well aware of the "passageway business" - in which trusts and brokerages cooperate with banks to transfer banks' assets off their balance sheets so banks can circumvent regulatory targets such as lending quotas, capital adequacy requirements and loan-to-deposit ratios.

Funds are relayed through layers of institutions, and costs rise with every layer.

Regulatory targets, particularly loan-to-deposit ratios, are driving banks to do whatever it takes to increase their deposit bases at certain times, which means banks have to offer higher yields to depositors. Borrowers usually must deposit certain sums to secure a loan.

Taking into account these problems, the document ordered regulators to adjust their assessment metrics so banks are not forced to undertake such activities. The document also encouraged banks to "broaden their financing channels" through such means as bond issues and asset securitization.

The central government is right in identifying all the problems, but improving the situation on the ground depends on how these guiding principles are implemented. At a recent meeting on how to lower borrowing costs for small businesses, I heard many firsthand stories of corporate borrowers.

Duan Yingbi, a veteran official who has long dedicated himself to poverty alleviation and lending to rural borrowers, said after years of efforts, rural borrowers are finding it easier to get a loan. The acute problem now is the cost. The average rate is about 20 percent.

"We know that the rate is high for farmers, but the problem is the operating expenses for us are high, too: no less than 10 percent. And we have to add the 8 percent guarantee fees. We run a very thin margin. We can't reduce the lending rate further, otherwise we can't survive," he said.

What struck me is that several years ago, when I was a junior journalist, I heard about the same stories. And I heard about the same prescriptions.

Time has passed, but the problems and solutions have barely changed.

The country is not lacking in those wise enough to make suggestions. What it lacks is the ability to put those suggestions into practice.

Duan said the fundamental factor impeding substantial financial reform is excessive concerns about risk.

"The real thinking among regulators is, 'I can barely handle the existing financial institutions, how can I handle more?' " Duan said.

But unless market access is genuinely improved, more players are introduced, more cartels are broken and more direct financing is bolstered, the predicament of high borrowing costs will not be solved.

|

|

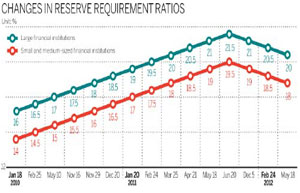

| Nation's big five banks plan bond sales in order to boost their capital | More lenders make RRR cuts |