It is heavily dependent instead on the sale of land, mainly through local government financing vehicles, or LGFVs, which make up more than a third of income. The recent Deutsche Bank report predicts that land sales revenue will slump 20 percent in 2015.

It comes at a time when the central government is also trying to reform local government financing by allowing municipalities to issue local bonds. Any new system is unlikely to be in place to alleviate the immediate shortfall.

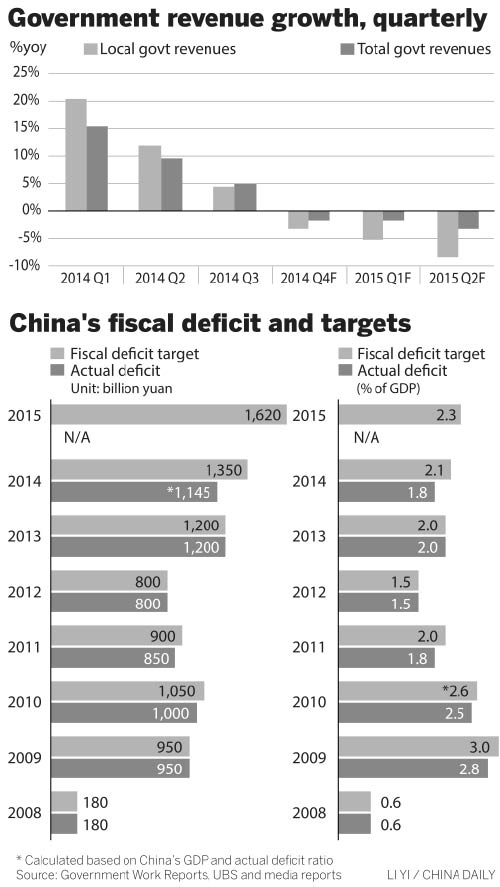

George Magnus, senior independent economist with UBS based in London and leading China commentator, said this makes the fiscal squeeze all the more severe.

"I think it is one of those difficult periods of transition that China is going through, principally because of the fallout and slowdown in real estate and also what is happening to land prices, which comprise about 25 to 30 percent of local government revenues," he said.

Zhu Ning, deputy director of the Shanghai Advanced Institute of Finance, does not believe this will lead to fiscal responsibility at local level.

"There was a pilot program back in 2012 with Zhejiang, Chongqing and Guangdong all able to issue bonds. They actually ended up trading at a lower yield than (China) treasuries," he said.

"This was because those who bought them thought they were safer than central government bonds on the reasoning that the government would not stand by and do nothing if there was a problem with this funding. So you weren't creating this independence or financial discipline that is required of this process."

Not everyone believes China should tighten its belt. Liu Zhiqin, senior fellow at the Chongyang Institute for Financial Studies at Renmin University of China, is worried austerity could store up even greater future fiscal problems if it brings growth to a shuddering halt.

"In my view government economic policy is too passive. I think if it pursues an austerity policy this year and cuts government expenditure, it would be the wrong thing to do."

He believes there should be major expenditure on healthcare, education and other social security measures.

Magnus at UBS also thinks China can avert a major financial crisis.

"I just don't think there is any point in anticipating or trying to predict China is going to have a financial crisis because the likelihood is that it probably won't. It can probably internalize it in ways that we in the West can't. This does not mean, however, that it hasn't got a debt or a growth issue because it clearly has."