China Construction Bank Corp said net profit for the first half of the year remained flat due to rising bad loans. The bank's net profit for the January-June period rose just under 1 percent year-on-year to 132.24 billion yuan, a fraction higher than the 130.97 billion yuan for the same period last year.

Bank of China Ltd said its first-half net profit rose 1.69 percent from a year earlier due to higher interest income. Net profit for the six months ended June 30 was 94.99 billion yuan, up from 93.41 billion yuan a year ago, the country's fourth-largest commercial bank by assets said.

"As China deepens economic reforms, improves the economic structure and pushes forward major national development strategies, the economy will remain on a healthy track and bring a wider space of business transformation and innovation for banks," Jiang said.

Zeng Gang, a research fellow at the Chinese Academy of Social Sciences' Institute of Finance and Banking, said: "It is quite normal for some banks to have a negative growth in net profit, as many industries are suffering from overcapacity and financial losses amid the economic downturn. Not to mention that the government requires banks to support the real economy by taking more credit risks and lowering banking fees. The fall in profit growth for banks will eventually benefit the real economy in the long run."

Bad loan growth adds to pressures

Mounting bad loan levels are set to add more pressure to Chinese lenders during the second half of the year, experts said.

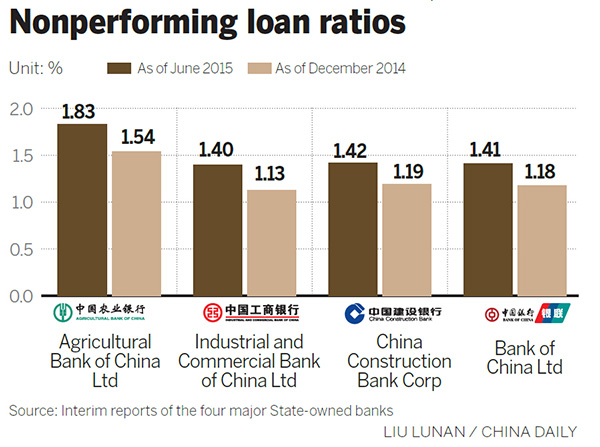

The average nonperforming loan ratio of the banking sector is expected to reach 1.6 to 1.8 percent for the year, compared with 1.5 percent at the end of June.

As of June 30, Agricultural Bank of China Ltd posted the highest NPL ratio of 1.83 percent among the four largest State-owned banks, up 29 basis points from the end of last year. The NPL ratios of the other three banks increased by more than 20 basis points to around 1.4 percent.

During the first six months of this year, Industrial and Commercial Bank of China Ltd, the nation's largest lender by assets, had a 37 percent increase in overdue loans and a 31 percent increase in special-mention loans.

Although nonperforming loans are on the rise, Zeng Gang, a research fellow at the Chinese Academy of Social Sciences' Institute of Finance and Banking, said they are reasonable losses for banks because the corporate credit conditions are decided by the macroeconomy, which still remains sluggish.

"The current NPL ratios are within a controllable range," Zeng said.