Pension funds inch closer to stock market

|

|

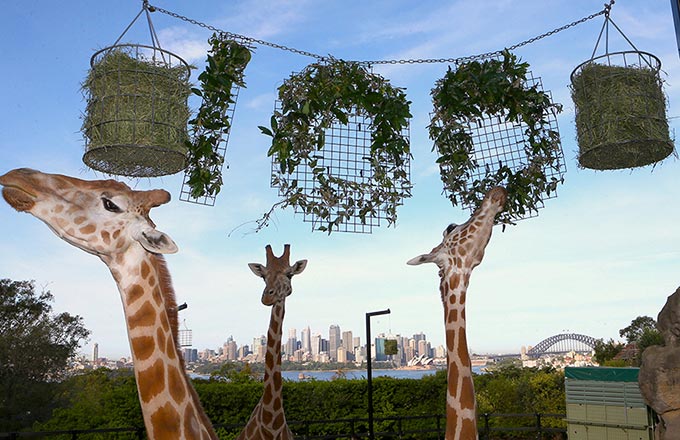

An investor checks stock information on his mobile phone in front of an electronic board showing stock information at a brokerage house in Beijing, February 16, 2016.[Photo/Agencies] |

The Ministry of Human Resources and Social Security said pension funds investment operation will be launched soon, and experts predict that 400 billion yuan ($60 billion) could be invested in the stock market in the first batch itself, the China Securities Journal reported.

Entrusted investment contracts formulated together with the Ministry of Finance and the National Council for Social Security Funds have been released, Li Zhong, spokesperson of the Ministry of Human Resources and Social Security, said on Tuesday.

The first batch of pension fund management institutions will be chosen by the end of this year, launching investment operation officially, Li added.

In addition, the government will speed up the formulation of related policies, such as the review method of custodian institutions and investment management institutions, said the spokesman.

Based on cumulative balance, investment limit and entrusted proportion, the first batch of pension fund is expected to be 400 billion yuan, equivalent to 1.1 percent of total circulation market value, the newspaper quoted Zhang Jing, an analyst of Huatai Securities, as saying.

China's pension fund, which accounts for approximately 90 percent of the country's total social security fund pool, had net assets of 3.98 trillion yuan by the end of 2015, according to data from the Ministry of Human Resources and Social Security.

For years, China's pension funds were parked with banks in the form of deposits, or were invested in treasury bonds with low yields.

On May 1, the national guideline to regulate the management of the pension funds took effect. It is the first of its kind issued by the central government.

The guideline allows the country's pension funds to invest in riskier products, including fixed-income products, stocks and private equity funds.