International investors will get their rewards

Foreign investors look certain to benefit from China's decision to cut red tape in the financial sector.

The National Australia Bank Ltd stressed that greater liberalization will open up the capital markets and reward those who have been "patient and invested" in the mainland.

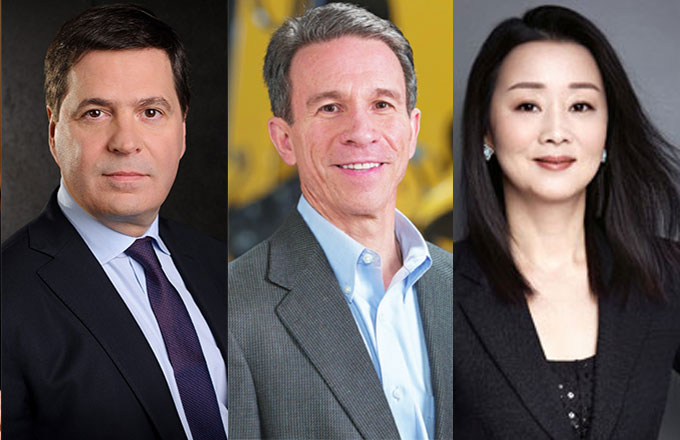

"This is a key step toward internationalization of the renminbi," said Christy Tan, head of markets strategy and research in Asia for NAB.

"It is good news for those who have been patient, and invested in China and Chinese banks," she added.

But Tan remained cautious when it came to competing with local lenders in their own backyard.

She said foreign investors will be "selective and prudent" when looking at the banking and insurance markets here.

"From the foreign investment perspective, they will be quite prudent, quite strategic and quite selective in the financial sector," Tan said.

Yet in the medium term this will have a positive impact on foreign direct investment.

It will also illustrate that China's reform agenda is still a key priority for the central government.

"In the medium term, this has positive implications for foreign direct investment," Qu Hongbin, co-head of Asian economic research and chief China economist at HSBC Holdings Plc, said in a research note.

"It will also be important for the reform agenda, such as debt restructuring and developing the equity and bond market," Qu added.

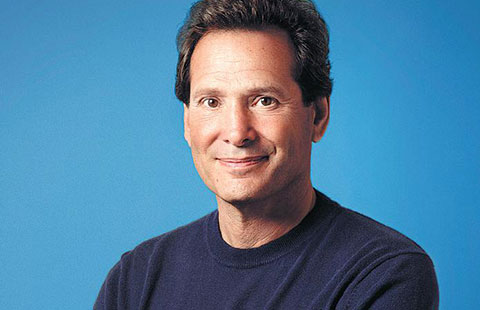

Overall, the decision will have a profound influence on the sector, according to Tom Orlik, chief Asia economist at Bloomberg Intelligence. In a research note, he said this latest move to further open up the mainland's financial industry is primarily aimed at reducing nonperforming loans and improving the efficiency of the sector.

"Bloomberg Economics' view is that China's prime motivation is to help manage down a stock of bad loans, and inject greater efficiency into the financial sector," he said in the note.

"Looking forward, the shift has far-reaching implications for both the operation of China's economy and the opportunities for foreign financial firms," he added.