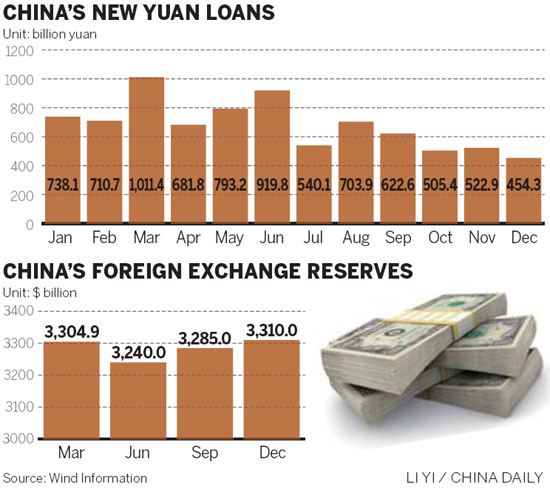

Chinese lenders extended fewer new yuan loans for the third month in a row in December as non-bank financing continued to become more common, according to central bank data released on Thursday.

|

|

|

A Bank of China branch in Nanjing, Jiangsu province. New yuan lending reached 8.2 trillion yuan ($1.3 trillion) in 2012, up 732 billion yuan from the previous year, the central bank said on Thursday. [Photo/China Daily] |

The amount of new yuan loans made by Chinese lenders fell to 454 billion yuan ($72.91 billion) in December, down by 29 percent year-on-year and the biggest drop seen in three years, data from the People's Bank of China showed.

"The decrease in new loans mainly resulted from monetary authorities maintaining their prudent stance and not loosening policies further," said E Yongjian, senior economist at Bank of Communications Ltd. The amount of medium- and long-term corporate loans extended in December went down by 15.4 billion yuan, showing their second monthly decline in a row.

"This indicates enterprises are more inclined to obtain financing through bond sales, entrusted loans and trust loans," E said.

The proportion of yuan loans to total financing had declined to 52 percent by the end of last year, the smallest figure in 10 years. The proportion of trust loans to total financing, meanwhile, went up to 8.2 percent, up by 6.6 percentage points year-on-year, and that of bond financing increased by 3.7 percentage points to 14.3 percent.

The total value of social financing, which includes bank and non-bank loans, bond issuances and stock sales, stood at 15.8 trillion yuan for 2012, up by 2.9 trillion yuan from the previous year, the central bank's data showed.

Corporate bond issuances went up by 65 percent in 2012 to 2.3 trillion yuan, and the value of trust loans increased more than six times to nearly 1.3 trillion yuan.

Analysts have questioned if China's plan to use investment to stimulate its economy will prove practicable if it cannot obtain needed financial backing, especially from banks, which are contending with a decline in the quality of their assets.

"But the economy's increasing dependence on less-regulated financing channels, such as trust loans, might be very risky," said Lu Zhengwei, chief economist at the Industrial Bank Co.

Louis Kuijs, chief China economist at the Royal Bank of Scotland Group and a former World Bank economist, said: "In 2012, we saw a new takeoff of the 'shadow-finance, such as entrusted loans, trust loans and bank acceptance bills, as well as bond financing, after a clampdown in 2011."

He said bank lending appears to contribute more to China's growth than "shadow banking" and that monetary aggregates have a greater influence on the economy than do interest rates.

December saw M2, a broad measure of money supply that takes into account all deposits and cash in circulation, increase 13.8 percent year-on-year, down from the 13.9 percent increase recorded for the month before.

China's economy might still have a hard landing in 2013, despite market expectations, the financial services company Societe Generale SA said in a report.

"Our core scenario is that China will grow by 7.4 percent in 2013," it said. "There is still a chance, however, that China could land hard, with growth of less than 6 percent.

Kuijs said there is a chance fiscal policy will be relied on more to support growth in 2013.

"Our results suggest that, with increasing concerns about leverage but the fiscal position still quite solid, this would make sense in that the impact of fiscal expansion on growth is relatively large," Kuijs said.

wangxiaotian@chinadaily.com.cn