Experts are calling for a more flexible yuan exchange rate and further opening of the capital account to ease pressure on the country's massive foreign exchange reserves, as China's holdings of United States' government debt hit a record high.

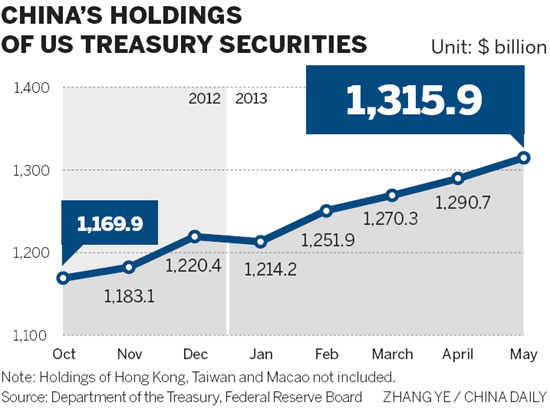

As the biggest foreign creditor to the US, China increased its holdings of US Treasury bonds for the fifth consecutive month in May to $1.32 trillion, even as foreign demand for the securities fell for a second consecutive month, according to new data from the US Treasury on Tuesday.

Japan, the second-largest buyer, trimmed its holdings by 0.2 percent to $1.11 trillion, while foreign investors as a whole decreased their holdings by $39.2 billion, said the Treasury report.

He Weiwen, co-director of the China-US/EU Study Center at the China Association of International Trade, said buying more US Treasury securities was a response to higher yields on dollar-denominated assets on the back of a strong dollar and the fact that there have been no defaults involving the bonds.

However, He said, China's increase amid overall weakening demand for US Treasury bonds was also because of a lack of alternative investment options for the country's massive foreign reserves.

Sohpii Weng, an economist for global research at Standard Chartered Bank in New York, said the yield on 10-year Treasury notes surged by 49.9 basis points in May, as many speculated on the US Federal Reserve's move to "taper" off its $85 billion-a-month bond-buying program, also known as QE3, or quantitative easing 3.

On Wednesday, US Federal Reserve Board Chairman Ben Bernanke gave his semi-annual testimony to Congress, where he reinforced his previous remarks on "tapering".

Weng said current levels may remain attractive to central banks, which normally have longer-term investment strategies compared with most private investors.

"Considering that China remains the US's second-biggest trading partner, in the context of a US dollar-positive environment with the Federal Reserve expected to start reducing QE later this year, dollar assets such as US Treasuries are likely to remain targets for central banks, including China," said Weng.

Guo Feng, a senior economist with the Washington-based Institute of International Finance, said China has been a large and stable source of demand for US Treasuries, contributing to their low and stable yields in the past few years.

"Given the recovery in the US and sluggish economic growth in Europe, I expect China to continue to buy US Treasuries in the coming months," he added.

But He argued that China's increasing of its holdings in US Treasury securities was only an interim move, and the volume would stabilize or even decrease over the long term.