Asset firms can resolve local debt

Updated: 2013-10-29 23:47

China should consider setting up more provincial asset management companies to strip off bad assets in the expanding local financial sector and to guard against risks related to local governments' debt, experts said.

"With an increasing number of local banks and village banks, it's necessary to have more asset management companies at a provincial level to help handle their growing non-performing assets," said Zhao Quanhou, head of financial research at the Fiscal Science Research Center, which is affiliated with the Ministry of Finance.

He said such local companies would be complementary to the "Big Four" national AMCs, which deal mainly with policy banks and major national banks.

In 1999, the central government set up four national AMCs: China Cinda, China Orient, China Huarong and China Greatwall under the direct management of the Ministry of Finance, to handle the bad loans of commercial banks, which totaled 1.4 trillion yuan ($230 billion).

In April this year, local authorities approved a financial asset management company in Jiangsu province launched by the government-owned Wuxi Guolian Development Co.

The move will mark the birth of the first local version of a national AMC, and is expected to help handle bad loans for local banks that suffered heavy losses stemming from the lackluster shipbuilding and solar sectors.

Meanwhile, preliminary work to set up a provincial AMC in Zhejiang, which will be led by the State-owned Zhejiang International Business Group, has also entered the final stage, according to Ding Junzhe, president of the Zhejiang-based Holdgold Asset Management.

"It's imaginable that AMCs on a provincial level will spring up all over the country," Ding wrote in a research note.

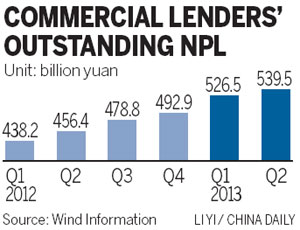

The calls for more AMCs are largely because of the rising non-performing loans in the banking sector.

According to the half-year reports of 16 listed banks, their bad loans added up to 440 billion yuan by the end of June, 40 billion yuan more than in January. All of the 16 banks saw increases in their bad loan balances.

Last week, Agricultural Bank of China Ltd — the country's third-largest lender — announced a plan to sell non-performing assets valued at 10 billion yuan.

Meanwhile, China's five major banks have written off 22.1 billion yuan of debt in the first six months of the year, compared with 7.65 billion yuan a year earlier, according to a Bloomberg News report citing company filings.

In Wenzhou, a hub for private businesses, the non-performing loan ratio of commercial banks was reported to be as high as 4 percent. Some analysts said that the real situation could be even worse.

"The 'Big Four' national AMCs are deeply rooted nationwide, thus are fully capable of dealing with the problem assets among commercial banks," Ding said.

He said that setting up more local AMCs would mainly be to respond to the expanding debt scale in local governments' financing platforms, which might undermine the financial stability of the world's second-largest economy.

Data from the China Banking Regulatory Commission showed that the local governments' debt balances amounted to 9.7 trillion yuan by June, of which 1.85 trillion yuan will be due at the end of the year.

Officials have expressed on many occasions their lack of solvency. Some are willing to sell State-owned fixed assets to make repayments.