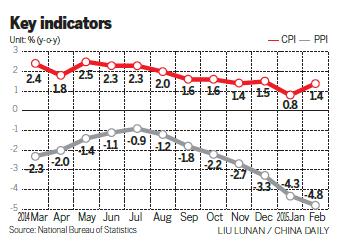

Third straight year of industrial deflation as PPI sinks 4.8 percent

Inflation at the consumer level rebounded more than expected last month, lifted by a surge in food prices during Spring Festival, while industrial deflation accelerated, the National Bureau of Statistics said on Tuesday.

The Consumer Price Index rose 1.4 percent year-on-year in February, compared with a five-year low of 0.8 percent in January, as the long holiday (from Feb 18 to 25) boosted demand.

Distortions caused by the timing of the lunar festival, which began on Jan 31 last year, played a part, the NBS said.

Food prices rose 2.4 percent, compared with 1.1 percent in January. Non-food inflation climbed to 0.9 percent from 0.6 percent, as prices of household goods and entertainment increased.

The average CPI for the first two months was 1.1 percent, but that was still below December's 1.5 percent, according to the NBS.

Yi Gang, deputy governor of the People's Bank of China, the central bank, said that the CPI may keep rising for some time, meaning that deflation is unlikely in the consumer sector.

"There are more such deflation risks in Japan and Europe," he said.

Song Yu, an economist at Goldman Sachs Group Inc, said that the higher-than-expected CPI in February will likely ease policymakers' concerns about weak growth and falling consumer prices.

But at the wholesale level, deflation picked up speed last month. The Producer Price Index fell 4.8 percent, compared with 4.3 percent in January, led by continued price drops in major product groups, particularly in the mining sector.

The PPI has fallen for 36 straight months, an indicator of continuing weak market demand.

The PPI for oil declined 42.4 percent and that for ferrous metals dropped 21 percent last month.

Deflation at the producer level is expected to persist as manufacturers grapple with excess capacity, lower investment growth-particularly in the real estate sector-and subdued energy prices, said Chang Jian, an economist at Barclays Capital.

The combination of "soft CPI inflation and widening PPI deflation" calls for further monetary easing, she said. "Monetary policy needs to be more proactive to deal with near-term cyclical challenges."

Chang forecast at least two more cuts in banks' required reserve ratio in the first half of the year and one benchmark interest rate cut in the second quarter.

At the annual National People's Congress, China lowered its inflation target for this year to 3 percent from 3.5 percent last year. The CPI was up 2 percent in 2014.

The NPC also decided to lower the full-year GDP growth target to "around 7 percent" from last year's 7.5 percent. China achieved growth of 7.4 percent in 2014, the slowest pace in 24 years.

In Premier Li Keqiang's Government Work Report, released on March 5, he reiterated that monetary policy needs to be balanced to achieve a reasonable pace of growth in credit and total financing.