|

|

An attendee photographs a Huawei Ascend P7 smartphone, manufactured by Huawei Technologies Co, during its launch in Paris on May 7. A number of China-made and China-branded handset makers have been emerging onto the global smartphone stage at unprecedented speed. Chris Ratcliffe/Getty Images/Bloomberg |

Homegrown vendors could be world leaders within five years

Lei Jun, who has been dubbed "China's Steve Jobs", said recently that he wanted his fast-rising handset maker Xiaomi Corp to become the world's top player within five to 10 years.

Bruce Sewell, Apple's general counsel and senior vice-president of legal and government affairs, told a panel discussion at the World Internet Conference that there are "many good competitive phones in China" in a nod to Xiaomi founder Lei, sitting alongside him.

The three-day conference concluded on Nov 21 in Wuzhen, Zhejiang province.

But when asked about Lei's previous claims that Xiaomi will become the world's market leader in smartphones, he said: "It is easy to say, it is more difficult to do", to laughter and applause from the audience.

Lei shot back the reply: "In this magic land, we produced not only a company like Alibaba, but a small miracle like Xiaomi."

A miracle indeed.

The Beijing-based Xiaomi made its first phone only three years ago, yet by the end of this year's third quarter it ranked as the world's third-largest player by shipment volume.

But Xiaomi is far from being China's only handset-making success story.

By selling cutting-edge Android smartphones at much lower prices compared with Apple, a number of China-made and China-branded handset makers have been emerging onto the global smartphone stage at unprecedented speed.

Analysts and insiders say that Chinese players have successfully transformed themselves from followers to competitors who can run neck-and-neck with Western players.

But the real questions remain: will they ever become dominant leaders in the world, and when?

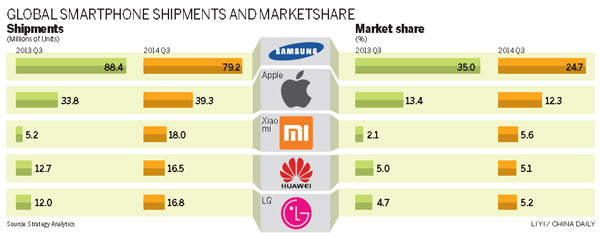

According to Strategy Analytics, a leading multinational consultancy, Chinese players occupied five slots in the top 10 global smartphone vendors list in the third quarter. In the top five list, Xiaomi ranked third and Huawei Technologies Co Ltd was fifth.

In the third quarter in 2011 just two Chinese vendors were among the top 10 and none were in the top five.

"China plays a key role in global smartphone manufacturing. We estimate roughly 70 percent of smartphones sold in 2013 worldwide were manufactured in China," said Linda Sui, director of Wireless Smartphone Strategies with Strategy Analytics.

"Now the big change is that more and more 'made-in-China' smartphones come from Chinese brands, rather than international brands."

The California-based Sui predicts that Chinese vendors will increase their share of the global market in 2015 - but she added that in the short term it still remains difficult for them to seriously challenge the industry's top two players, heavyweights Samsung Electronics Co and Apple Inc.

Samsung accounted for 23.8 percent of market share and remained the clear market leader in the third quarter despite a declining shipment volume of 8.2 percent year-on-year, according to International Data Corporation, a global market intelligence provider. Apple took 12 percent, followed by Xiaomi's 5.3 percent.

IDC's top five list is a little bit different from the one produced by Strategy Analytics, with Lenovo Group Ltd (5.2 percent of the global market share) at fourth and LG Electronics (5.1 percent) fifth.

Even taking Lenovo's acquisition of Motorola's smartphone business at the end of October into account, it is still estimated to have 8 percent of the global market share in the third quarter, well behind Apple's 12 percent.

Samsung and Apple cannot be overtaken within one year, said James Yan, an analyst with IDC.

"I don't see Chinese players becoming game changers in 2015 but that does not mean that they cannot challenge the positions of Samsung and Apple in another three to five years," Yan said.

Yan said the development of Chinese vendors has now moved into the fast lane thanks to years of experience manufacturing smartphones for overseas brands.

Adam Xu, a partner with multinational consultancy Strategy&, said that China's growing reputation for design, its strong distribution systems, and its growing social media scene, mean the country's local companies will continue to emerge and grow at a rapid pace.

"Increasingly, Chinese local companies have staff trained in multinational companies - that also helps Chinese emerging players succeed even more quickly," he said.

Xiaomi is arguably one of the world's best examples of a company built on social media marketing. Just like Apple, it has nurtured millions of its own die-hard fans who are willing to pay thousands of yuan, just to get into the company's new product launch press conference.

According to a recent report from Avanti, a Shanghai-based consumer behavior research division of TrendForce, despite Apple and Samsung holding onto the two top slots in brand awareness, the rise of Chinese brands will continue.

Chinese consumers still show the most interest for Apple (50 percent) and Samsung's products (25 percent), but interest in buying Xiaomi's products jumped from 3 percent in the first quarter of 2012 to 27 percent in the second quarter this year.

During the same period, interest in Huawei's products jumped from 3 percent to 23 percent and for Lenovo from 8 percent to 18 percent.

Consumer interest for both Nokia and HTC dropped.

"Rather than patriotism, people buy these made-in-China phones because of their increasing cost performance," said Yan, adding that he expected Chinese vendors to gain more market share.

However, Xu from Strategy& thinks the shift is more complicated than just cost, insisting that technology is what is moving the market.

"HTC was a strong player in the market but today it is struggling. Technology shifts very quickly. It could be the case that Chinese local players are increasingly competitive at the moment, but if there is another major technology shift, as we had to touchscreen smartphones, for instance, the landscape could be suddenly very different."

What is agreed by analysts is that no Chinese vendor can become dominant in the world without successfully expanding overseas. Many have made effort to conquer new markets, but most are still China-focused.

According to IDC, 90 percent of Xiaomi's sales are still generated in China, while Huawei, which has achieved the best overseas expansion of any Chinese vendor, sees half of its sales from home.

Apart from gaining intellectual property rights -considered the main barrier for Chinese vendors tapping into overseas markets, especially mature ones - product quality, branding, innovation, and growing business across many countries determine whether brands can be considered truly global or not, said Xu, who considers Huawei as the country's strongest international vendor.

Yan said that many Chinese vendors still hope to shine like Apple, but for most firms the competition still remains huge.

"It is more likely for Chinese vendors to develop in a Samsung style - developing high-end, medium-end and low-end products simultaneously," he said.

mengjing@chinadaily.com.cn