|

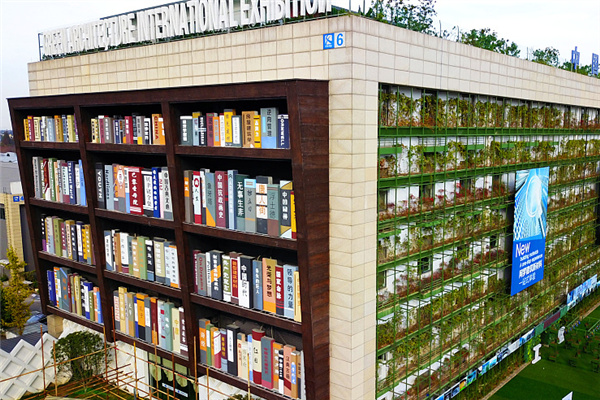

A man passes by a poster promoting credit cards in Chongqing. Asianewsphoto |

For decades, the free-spending US consumer was the engine of growing global prosperity.

Americans' credit-fueled hunger for goods sparked a worldwide export boom. Now, with export demand from the United States and the West much softer than before, more global market observers believe that the increasingly affluent Chinese consumer might be the new engine of planetary prosperity.

The concept of the "free-spending Chinese consumer" did not exist until very recently. Historically, Americans borrowed and spent, while Chinese people saved.

Two years ago, Chinese consumers were saving 40 percent or more of their incomes, while American consumers were saving zero percent - or even less - of theirs.

Now the Chinese government is promoting consumer spending - the idea that "to spend is patriotic." And to help people become freer with their hard-earned renminbi, China is making it easier than ever before to access consumer credit.

The result has been an unmistakable "credit boom," with consumer borrowing growing 200 times in the past 10 years. How China manages this will determine its success, and countries around the world will be watching.

Spending as 'patriotic'

Spending is promoted as "patriotic" in China because domestic consumers are now seen to be the key to maintaining the country's swift economic recovery.

While the economies of the West are stalled, China's massive government stimulus programs and loose monetary policies have fueled continued GDP growth for the country. In 2009, it is set to once again top 8 percent.

Now, in a shift described by the newspaper, The Christian Science Monitor, as "a cultural movement from one of personal savings to mass consumerism and heavy spending", organs of the government are increasingly urging Chinese consumers to contribute to sustaining this economic performance by fighting their tendencies to save. Chinese consumers, instead, are being urged to buy more.

At least partly because of this focus on spending, China has in recent years witnessed an explosion of consumer credit. The current $500 billion consumer credit market will soon quadruple to $2.35 trillion, according to the trade publication Asian Banker. (The comparable US market is $3.6 trillion.)

Moreover, this massive growth is occurring in a country that is relatively new to consumer credit. It was first introduced in 1998 to allow people to get mortgages to buy houses.

While consumer credit is still a relatively new concept in China, tracking and reporting consumer credit behavior is newer still.

The State Credit Bureau was founded in 2003. This young system must cope with an avalanche of new credit cards.

The credit avalanche

Statistics from a recent report by People's Bank of China shows that there are currently an estimated?162 million credit cards, and the number is growing at 30 percent annually.

What's more, there is a fear in some quarters that banks are issuing cards - and the credit lines that go with them - without having a clear idea how credit-worthy their customers are.

Should Chinese regulators worry about this sudden wave of consumer credit?

Spend enough time talking to financial officials outside China, and you too often hear the phrase "economic decoupling" to explain why China is going to be different from the West when it comes to igniting and successfully managing an extraordinary consumer credit boom.

Before the crash of September 2008, many macroeconomic experts thought the Chinese economy - and that of Asia in general, other than Japan - was decoupled from that of the West. Then a synchronized global dip post-9/15 argued against the theory of decoupling.

Now, China's swift recovery while the rest of the world struggles is bringing back the decoupling argument.

Decoupling

As with every boom that went bust in the past few decades, the theory of decoupling says, "This time it's different. This time the old rules don't apply." Yet the remarkable economic history of the world's most populous nation would suggest that it is too soon to decisively cry victory on either side of this debate.

No matter what verdict history renders on the decoupling theory, I believe China must keep in mind the old, proven rules as it creates its enormous new consumer credit sector.

It can learn from the challenges of many Western economies in order to effectively manage the opening up of consumer credit to ensure that its own economy doesn't meet the same fate.

Given the newness of its system and the uncertainties surrounding the credit-worthiness and behavior of borrowers, it is dangerous to expand consumer credit without honoring the fundamental principles of sound underwriting.

The confidence of China's financial leaders is understandable. They are presiding over a growing economy while most others are shrinking. China is marching toward global economic leadership.

Nevertheless, it would be unwise for China to ignite a consumer credit boom that is so aggressive it gets out of hand.

Now more than ever, China's economic future rests on the wisdom of leaders who are able to balance its transformation from an export-driven economy to a more robust, multi-faceted financial system.

The loosening of its consumer credit system should be backed by a sound risk management infrastructure, transparency and a continued focus on solid criteria for lending.

Recent history has shown that these time-honored practices will be very important to ensure that China continues to enjoy prosperity and economic stability well into the future.

Mark N. Greene is chief executive officer of FICO, a leader in analytics and decision-management technology. The views expressed here are his own.

(China Daily 10/26/2009 page2)